FATCA and CRS

FATCA

The Foreign Account Tax Compliance Act (FATCA) is a US Regulation which requires all Foreign Financial Institutions (FFIs) across countries to identify and report all accounts owned by ‘US persons’ to the relevant regulators. FFIs who do not comply with this regulation may themselves suffer 30% withholding on their US sourced financial inflows. Frequently asked questions about FATCA are available at: http://www.irs.gov/Businesses/Corporations/FATCAFAQs

The US has partnered with over 150 countries by signing Intergovernmental Agreement (IGA) which makes it simpler as well as mandatory under local legislation for FFIs based in the partner countries to comply with the requirements under FATCA. You can also find more information about the IGAs at:

http://www.treasury.gov/resource-center/tax-policy/treaties/Pages/FATCA.aspx

The CLSA Group has registered all its FFI entities on the FATCA portal maintained by the Internal Revenue Service (IRS) and has successfully obtained unique Global Intermediary Identifier Numbers (GIIN) for each FFI entity. These have been listed on the IRS portal and can be accessed at: http://apps.irs.gov/app/fatcaFfiList/flu.jsf

CRS

The Organization for Economic Cooperation and Developments (OECD) has developed the Standard for Automatic Exchange of Financial Account Information (AEoI), also commonly referred to as Common Reporting Standard (CRS). This requires financial institutions such as CLSA to identify the tax residencies of their clients and report the information to the local tax authorities.

Over 100 jurisdictions have signed the Multilateral Competent Authority Agreement (MCAA), which contains the detailed rules that govern the exchange of information amongst the signatory jurisdictions. The complete list participating countries and the status of local guidance is available on the CRS portal

FATCA and CRS request to our clients

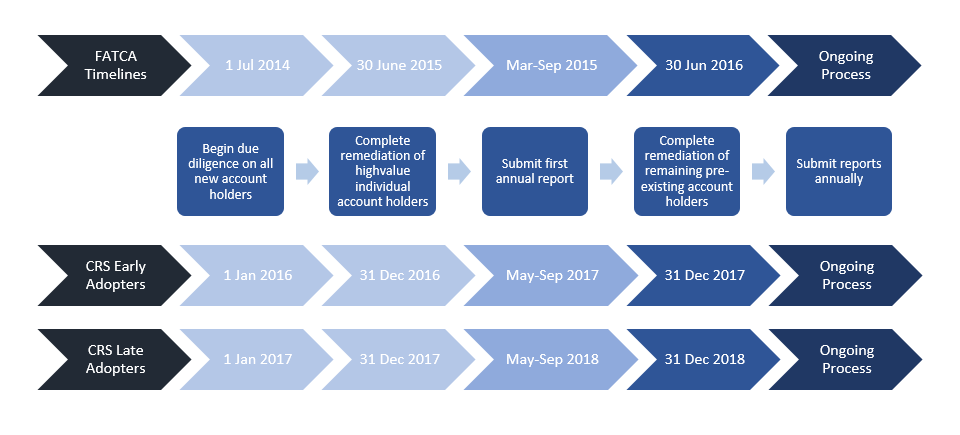

Foreign Account Tax Compliance Act (FATCA) is a US regulation in effect since 1 July 2014. Its aim is to prevent US persons, using offshore accounts, from evading US taxation. The US has partnered with over 150 countries by signing Intergovernmental Agreements (IGA) that require such countries’ local financial institutions to identify accounts held by US persons. Information relating to such accounts is ultimately exchanged with the US.

Common Reporting Standard (CRS) is a global initiative lead by OECD body. Its aim is to prevent individuals and entities, using offshore accounts, from evading taxation in participating countries. CRS came into effect on 1 Jan 2016 in the ‘Early Adopter’ countries (e.g., UK), while it came into effect from 1 Jan 2017 in the ‘Late Adopter’ countries (e.g., HK). Over 100 countries are committed to participate in the CRS initiative. They are legislating domestic laws that require local financial institutions (FIs) to identify accounts held by foreign tax residents, and report details of such accounts to local tax authorities, who will automatically exchange this information with tax authorities in other countries participating in the CRS initiative.

The clients need to submit their FATCA and CRS self-declarations to CLSA. Some clients may need to provide additional FATCA self-declarations for their US owner(s) and/or CRS self-declarations of their controlling persons.

The client need to inform CLSA and provide updated self-declaration within 30 days of any change in circumstance which may affect their tax residency status or may inundate the information contained in self-declaration previously submitted to CLSA.

The client is required to provide supporting documents to CLSA for verification of the information contained in their self-declarations.

The information collected may be shared with the relevant tax authorities as part of FATCA and CRS reporting obligations, and in response to specific request from the tax authority.

The clients need to ensure that accurate information is provided in their self-declarations since the tax authorities may penalize the clients for making an incorrect declaration either willfully or due to negligence.

Please note CLSA does not provide any form of tax advice. The clients should contact their own tax adviser if any tax related advice is required.

CLSA appreciates the continued support and patronage of all clients. CLSA is happy to provide non-tax related guidance to clients that may be of assistance to prepare and submit the self-declarations.

The clients may contact the team of FATCA and CRS specialists at CLSA via email: fatca-crs@clsa.com

80 Raffles Place, #18-01, UOB Plaza 1, Singapore 048624

Tel : +65 6416 7888

Fax: +65 6438 6316

Additional Information

CLSA has prepared FATCA and CRS self-declarations for all relevant legal entities in the CLSA group. These have been uploaded to the CLSA’s website and can be accessed at:

https://www.clsa.com/fatca-and-crs/#self-certification-clsa-entities

CLSA has prepared a FATCA and CRS Annexure to add related obligations to our Terms of Business. This annexure can also be accessed from CLSA’s website via the link:

https://www.clsa.com/assets/files/Terms_Of_Business/CLSA-Asia-Pacific-FATCA-Annex.pdf

General FAQ for both FATCA and CRS

Q1 What are the main steps involved in the process of submission of self-declarations to CLSA?

Clients need to do the following for submission of self-declarations to CLSA.

| Steps | Physical submission |

| 1. Download the self-declaration templates to be used |

|

| 2. Fill in data |

|

| 3. Tick the check boxes |

|

| 4. Submit self-declarations to CLSA |

|

| 5. Provide supporting evidence |

|

Q2 What are the supporting evidences / documents needed in addition to the FATCA and CRS self-declarations?

- For Individuals

- Identity Proof that displays the full name

- Passport or any other document issued by govt. that displays the nationality, date of birth and country of birth

- Address proof like bank statement, utility bills; separate for permanent and mailing address

- Copy of tax statement or any other government issued document that displays their tax identification number.

- For Entities

- Certificate of Incorporation / business registration that displays the full legal name, country, and registered address

- Address proof can also be like registration documents, or annual statements, Memorandum and Articles of incorporation, or Investment Management Agreement, that displays address

- Entity type can be supported with Memorandum and Articles of incorporation, or Investment Management Agreement, or any other business practice license

- Copy of tax statement or any other govt. issued document that displays their tax identification number.

Q3 How can you submit your FATCA and CRS self-declarations to CLSA?

- The FATCA and CRS self-declarations can be sent to us via normal mail or a soft copy can be emailed to CLSA at: fatca-crs@clsa.com

Q4 Does this self-declarations need to be resubmitted periodically?

- No, however, if the details of the client mentioned in the self-declarations changes then the client needs to provide updated self-declarations to CLSA within 30 days of the change in their details.

Q5 Why do I have to provide this FATCA – CRS information to CLSA?

- For FATCA : The US has signed intergovernmental agreements with the countries that CLSA operates in, to make it mandatory for financial institutions like CLSA present in those countries to obtain such self-declarations from clients

- For CRS : The local authorities in each country where CLSA operates in, has made it mandatory for financial institutions like CLSA present in those countries to obtain such self-declarations from clients

Hence, CLSA would not be able to open new accounts if such self-declarations are not provided by clients at time of new account setup.

Q6 What would CLSA do if I do not provide this FATCA – CRS information?

- CLSA may not open new accounts or offer additional products / services to clients who choose not to comply with CLSA’s request for documentation to establish a client’s status under FATCA or CRS.

- CLSA may exit the relationship with clients who decide not to provide the necessary information and documentation to CLSA within the required regulatory timeframe.

- Where clients refused to provide their self-declarations, CLSA is obliged to report them based on information available in our record to the relevant tax authority.

- CLSA may also be required to withhold tax on certain US source payments coming into the client’s account.

Q7 Who should I contact if I have some queries?

- CLSA is not authorized to provide you with any tax advisory.

- For other non-tax advisory queries, you may consult your relationship manager from CLSA who would help you understand this broadly.

- Specifically, all the account opening related queries can be directed to clientonboarding@clsa.com and all the FATCA and CRS related queries can be directed to fatca-crs@clsa.com

FATCA specific FAQ

Q1 What are the various types of FATCA self-declarations?

- There are broadly two types of FATCA self-declarations

- W8 – to be filled by Non-US persons

- W9 – to be filled by US persons

Q2 How many types of W8/W9 templates exist and how to select the appropriate W8/W9 template?

There is only 1 type of W9 template but there are 5 types of W8 templates. Below guideline can be used to select the appropriate template for submission to CLSA.

| Template | Instructions | Guideline to select relevant template |

| W-9 | Instructions for the Requester of W-9 | Any Beneficiary Owner (Individual or Entity) who claims they are Tax Resident in United States |

| W-8BEN | Instructions for W-8BEN | Any Beneficiary Owner (Individual only) who claims they are Tax Resident outside United States |

| W-8BEN-E | Instructions for W-8BEN-E | Any Beneficiary Owner (Entity only) who claims they are Tax Resident outside United States.

The form also contains options for the entities to declare themselves as exempted from FATCA |

| W-8IMY | Instructions for W-8IMY | Any person acting as an Intermediary rather than a Beneficiary Owner |

| W-8EXP | Instructions for W-8EXP | A foreign government, international organization, foreign central bank of issue, foreign tax-exempt organization, foreign private foundation, or government of a U.S. possession simply claiming the exemption from FATCA |

| W-8ECI | Instructions for W-8ECI | A foreign government, international organization, foreign central bank of issue, foreign tax-exempt organization, foreign private foundation, or government of a U.S. possession if they received income which is effectively connected with conduct of a Trade or Business in United States, and are not eligible to claim an exemption for chapter 3 or 4 purposes on Form W8EXP |

CRS Specific FAQ

Q1 What are the various types of CRS self-declarations?

There are three types of CRS self-declarations

- Individual – To be filled by natural persons who hold accounts at CLSA

- Entity – to be filled by a legal entity who hold accounts at CLSA

- Controlling Persons – to be filled by natural persons who exercise control of the legal entity

Q2 Where to obtain the templates of the CRS self-declarations?

- The templates of the CRS self-declarations are available here

- Click on above link and download the applicable self-declarations.

Q3 What is a TIN?

- Taxpayer Identification Number (TIN) is a unique combination of letters and/or numbers assigned to you/your entity.

- Some countries do not issue a TIN, and some countries may issue alternatives such as social security/national insurance numbers or company registration numbers.

- The OECD has published a list of the acceptable Taxpayer Identification Number (TIN) formats

Q4 Where is my tax residency?

- Your tax residency is the country where you are resident / registered for tax purposes.

- Each country has its own rules for defining tax residence.

- For more information on tax residence, please consult your tax advisor or the OECD AEOI portal.

Q5 If my entity is a passive NFE but do not have any natural person holding more than 10% by vote or value, who will be the controlling person?

- In cases where there are no such natural person with more than 10% ownership, the senior managing official who makes decision for the entity will be the controlling person.

- The entity will need to decide who their senior managing official is.

CLSA CRS self-declarations

Please use the self-declarations corresponding to the country where you are opening the account. For example, if you use CLSA Limited and CLSA India Private Limited, you will need to provide 2 CRS self-declarations due to different local legislation requirements.

| Country where you are opening the account | Applicable standard CRS self-declarations | ||

| Global

(Except South Korea and India) |

Individual | Entity | Controlling Person |

| South Korea | Individual | Entity / Controlling Person | |

| India | Individual | Entity | Controlling Person |

Self-Declarations of CLSA entities

CLSA has prepared the self-certifications (W-9/W-8BEN-E/W-8IMY/CRS) for our entities. CLSA will update these within 30 days of any change in circumstances. All the self-certifications are listed below, and the clients may download the forms of their booking entities. If in doubt, the clients may refer the trade confirmations they receive or they may also contact their Relation Manager to reconfirm the names of their booking entities.

| SR NO. | REGISTERED ENTITIES | COUNTRY | GIIN | FATCA TAX FORM | FATCA CLASSIFICATION | CRS FORM | CRS CLASSIFICATION |

| 1 | CITIC CLSA Funds SPC – CITIC CLSA CHINA A-SHARE ENHANCED INDEX FUND A SP | Cayman Islands | IWFS0F.99999.SL.136 | W-8BEN-E | Reporting Model 1 FFI | CRS FORM | Reporting FI – Investment Entity |

| 2 | CITIC CLSA Funds SPC – CITIC CLSA CHINA A-SHARE ENHANCED INDEX FUND B SP | Cayman Islands | WSR973.99999.SL.136 | W-8BEN-E | Reporting Model 1 FFI | CRS FORM | Reporting FI – Investment Entity |

| 3 | CITIC CLSA Funds SPC – CITIC CLSA CHINA A-SHARE ENHANCED INDEX FUND C SP | Cayman Islands | SVRXV7.99999.SL.136 | W-8BEN-E | Reporting Model 1 FFI | CRS | Reporting FI – Investment Entity |

| 4 | CITIC CLSA FUNDS SPC – CITIC CLSA INVESTMENT SCHEME 1 SP | Cayman Islands | 9XL4UB.99999.SL.136 | W-8BEN-E | Reporting Model 1 FFI | CRS FORM | Reporting FI – Investment Entity |

| 5 | CITIC CLSA Transformation Fund | Cayman Islands | D86SLV.99999.SL.136 | W-8BEN-E | Reporting Model 1 FFI | CRS FORM | Reporting FI – Investment Entity |

| 6 | CLSA Active Investment SPC Limited | Cayman Islands | LTL649.00067.ME.136 | W-8BEN-E | Reporting Model 1 FFI | CRS FORM | FI – Investment Entity |

| 7 | CLSA Active Investment SPC Limited – CLSA Stable Income Enhanced Fund SP | Cayman Islands | IBP9MB.99999.SL.136 | W-8BEN-E | Reporting Model 1 FFI | CRS FORM | FI – Investment Entity |

| 8 | CLSA Active Investment SPC Limited – CLSA Stable Income Fund SP | Cayman Islands | II0LSG.99999.SL.136 | W-8BEN-E | Reporting Model 1 FFI | CRS FORM | FI – Investment Entity |

| 9 | CLSA Active Investment SPC Limited – CLSA Stable Income Short-Duration Fund SP | Cayman Islands | B01E42.99999.SL.136 | W-8BEN-E | Reporting Model 1 FFI | CRS FORM | FI – Investment Entity |

| 10 | CLSA AI SPC | Cayman Islands | 4DZ5SR.99999.SL.136 | W-8BEN-E | Reporting Model 1 FFI | CRS FORM | Type B – Investment Entity |

| 11 | CLSA CT Limited | Cayman Islands | W54FJU.99999.SL.136 | W-8BEN-E | Reporting Model 1 FFI | CRS FORM | FI – Investment Entity |

| 12 | CLSA Global Markets Pte. Ltd. | SINGAPORE | LTL649.00064.ME.702 | W-8BEN-E W-8IMY |

REPORTING MODEL 1 FFI | CRS FORM | REPORTING FI – CUSTODIAL INSTITUTION AND TYPE B INVESTMENT ENTITY |

| 13 | CLSA Global Public Fund Series Open-ended Fund Company | Hong Kong | ZLHM3R.99999.SL.344 | W-8BEN-E | Reporting model 2 FFI | CRS FORM | Investment entity (Investment entity managed by another financial Institution in a participating jurisdiction) |

| 14 | CLSA Greater China Fund Limited | Cayman Islands | QIU1KG.99999.SL.136 | W-8BEN-E | Reporting Model 1 FFI | CRS FORM | FI – Investment Entity |

| 15 | CLSA India Private Limited | INDIA | LTL649.00016.ME.356 | W-8BEN-E |

REPORTING MODEL 1 FFI | CRS FORM | REPORTING FI – CUSTODIAL INSTITUTION |

| 16 | CLSA Limited | HONG KONG | LTL649.00000.LE.344 | W-8BEN-E W-8IMY |

REPORTING MODEL 2 FFI | CRS FORM | REPORTING FI – CUSTODIAL INSTITUTION AND TYPE A INVESTMENT ENTITY |

| 17 | CLSA Philippines, Inc. | PHILLIPPINES | LTL649.00031.ME.608 | W-8BEN-E |

REPORTING MODEL 1 FFI | CRS FORM | FI – CUSTODIAL INSTITUTION |

| 18 | CLSA Securities (Thailand) Limited | THAILAND | LTL649.00030.ME.764 | W-8BEN-E W-8IMY |

REPORTING MODEL 1 FFI | CRS FORM | FI – CUSTODIAL INSTITUTION |

| 19 | CLSA Securities Korea Ltd | KOREA | LTL649.00037.ME.410 | W-8BEN-E W-8IMY |

REPORTING MODEL 1 FFI | CRS FORM | REPORTING FI – CUSTODIAL INSTITUTION |

| 20 | CLSA Securities Malaysia Sdn. Bhd | MALAYSIA | LTL649.00069.ME.458 | W-8BEN-E W-8IMY |

Reporting Model 1 FFI | CRS FORM | REPORTING FI – TYPE A INVESTMENT ENTITY |

| 21 | CLSA SI 01 Limited | Cayman Island | YYBJB2.99999.SL.136 | W-8BEN-E | Reporting Model 1 FFI | CRS FORM | Reporting FI – Investment Entity |

| 22 | CLSA SI 02 Limited | Cayman Island | SJKB5D.99999.SL.136 | W-8BEN-E | Reporting Model 1 FFI | CRS FORM | Reporting FI – Type B Investment Entity |

| 23 | CLSA SI 03 Limited | Cayman Island | ET37DN.99999.SL.136 | W-8BEN-E | Reporting Model 1 FFI | CRS FORM | Reporting FI – Type B Investment Entity |

| 24 | CLSA Singapore Pte Ltd | SINGAPORE | LTL649.00025.ME.702 | W-8BEN-E W-8IMY |

REPORTING MODEL 1 FFI | CRS FORM | REPORTING FI – CUSTODIAL INSTITUTION AND TYPE A INVESTMENT ENTITY |

| 25 | PT CLSA Sekuritas Indonesia | INDONESIA | LTL649.00017.ME.360 | W-8BEN-E |

REPORTING MODEL 1 FFI | CRS FORM | REPORTING FI – CUSTODIAL INSTITUTION |

| 26 | CITIC CLSA Funds SPC | CAYMAN ISLANDS | LTL649.00060.ME.136 | W-8BEN-E | REPORTING MODEL 1 FFI | CRS FORM | REPORTING FI – TYPE B INVESTMENT ENTITY |

| 27 | CITIC Securities Brokerage (HK) Limited | HONG KONG | LTL649.00062.ME.344 | W-8BEN-E W-8IMY |

REPORTING MODEL 2 FFI | CRS FORM | REPORTING FI – CUSTODIAL INSTITUTION AND TYPE A INVESTMENT ENTITY |

| 28 | CITIC Securities Futures (HK) Limited | HONG KONG | LTL649.00063.ME.344 | W-8BEN-E W-8IMY |

REPORTING MODEL 2 FFI | CRS FORM | REPORTING FI – CUSTODIAL INSTITUTION AND TYPE A INVESTMENT ENTITY |

| 29 | CITIC Securities Asset Management (HK) Limited 中信證券資產管理 (香港) 有限公司( Formerly known as CLSA Asset Management Limited) |

Hong Kong | LTL649.00068.ME.344 | W-8BEN-E | Reporting Model 2 FFI | CRS Form | Custodial or Investment Entity |

| 30 | CITIC Securities International Capital Management Limited 中信證券國際資本管理有限公司 (Formerly known as CSI Capital Management Limited) |

BRITISH VIRGIN ISLANDS AND HONG KONG | LTL649.00066.ME.092 | W-8BEN-E W-8IMY |

REPORTING MODEL 1 FFI | CRS FORM | FI – CUSTODIAL INSTITUTION |

| 31 | CSI Financial Products Limited | BRITISH VIRGIN ISLANDS AND HONG KONG | LTL649.00057.ME.092 | W-8BEN-E | REPORTING MODEL 1 FFI | CRS FORM | REPORTING FI – TYPE C INVESTMENT ENTITY |

| 32 | CITIC Securities International Global Markets Limited 中信證券國際全球市場有限公司 (Formerly known as CSI Global Markets Limited) |

HONG KONG | LTL649.00061.ME.344 | W-8BEN-E W-8IMY |

REPORTING MODEL 2 FFI | CRS FORM | REPORTING FI – CUSTODIAL INSTITUTION AND TYPE A INVESTMENT ENTITY |

Glossary

FATCA Glossary

- Active NFFE means any NFFE that meets any of the criteria listed below:

- (a) less than 50% of the NFFE’s gross income for the preceding calendar year or other appropriate reporting period is passive income and less than 50% of the assets held by the NFFE during the preceding calendar year or other appropriate reporting period are assets that produce or are held for the production of passive income;

- (b) the stock of the NFFE is regularly traded on an established securities market or the NFFE is a Related Entity of an Entity the stock of which is regularly traded on an established securities market;

- (c) the NFFE is a Governmental Entity, an International Organisation, a Central Bank, or an Entity wholly owned by one or more of the foregoing;

- (d) substantially all of the activities of the NFFE consist of holding (in whole or in part) the outstanding stock of, or providing financing and services to, one or more subsidiaries that engage in trades or businesses other than the business of a Financial Institution, except that an entity shall not qualify for NFFE status if the entity functions (or holds itself out) as an investment fund, such as a private equity fund, venture capital fund, leveraged buyout fund, or any investment vehicle whose purpose is to acquire or fund companies and then hold interests in those companies as capital assets for investment purposes;

- (e) the NFFE is not yet operating a business and has no prior operating history, (a “ start-up NFFE”) but is investing capital into assets with the intent to operate a business other than that of a Financial Institution, provided that the NFFE shall not qualify for this exception after the date that is 24 months after the date of the initial organization of the NFFE;

- (f) the NFFE was not a Financial Institution in the past five years, and is in the process of liquidating its assets or is reorganising with the intent to continue or recommence operations in a business other than that of a Financial Institution;

- (g) the NFFE primarily engages in financing and hedging transactions with, or for Related Entities that are not Financial Institutions, and does not provide financing or hedging services to any Entity that is not a Related Entity, provided that the group of any such Related Entities is primarily engaged in a business other than that of a Financial Institution; or

- (h) the NFFE meets all of the following requirements for a “non-profit NFFE”:

- (i) is established and operated in its jurisdiction of residence exclusively for religious, charitable, scientific, artistic, cultural, athletic, or educational purposes; or it is established and operated in its jurisdiction of residence and it is a professional organisation, business league, chamber of commerce, labour organisation, agricultural or horticultural organisation, civic league or an organisation operated exclusively for the promotion of social welfare;

- (ii) is exempt from income tax in its jurisdiction of residence;

- (iii) has no shareholders or members who have a proprietary or beneficial interest in its income or assets;

- (iv) the applicable laws of the NFFE’s jurisdiction of residence or the NFFE’s formation documents do not permit any income or assets of the NFFE to be distributed to, or applied for the benefit of, a private person or non-charitable Entity other than pursuant to the conduct of the NFFE’s charitable activities, or as payment of reasonable compensation for services rendered, or as payment representing the fair market value of property which the NFFE has purchased; and

- (v) the applicable laws of the NFFE’s jurisdiction of residence or the NFFE’s formation documents require that, upon the NFFE’s liquidation or dissolution, all of its assets be distributed to a Governmental Entity or other non-profit organisation, or escheat to the government of the NFFE’s jurisdiction of residence or any political subdivision thereof.

- Certain investment entities that do not maintain financial accounts refers to an entity that is in the business of providing investment advice and/or managing investments for clients but that does not maintain financial accounts for its clients.

- Certified deemed-compliant FFI with only low-value accounts — A FI that meets the following requirements:

- The FI is not an Investment Entity;

- Each Financial Account maintained by the FI or any Related Entity must not exceed $50,000 taking into account aggregation and currency translation;

- The FI must not have more than $50m in assets on its sole balance sheet (and its consolidated balance sheet where it is in a group) at the end of its most recent accounting year.

- Certified deemed-compliant nonregistering local bank, under the Treasury Regulations, is a certified deemed-compliant FFI that must meet the following requirements:

- The FFI operates solely as (and is licensed and regulated by the laws of the country of incorporation or organisation and operates as) a bank, or a credit union or similar cooperative credit organisation that is operated without profit;

- The FFI’s business consists primarily of receiving deposits from and making loans to, with respect to a bank, unrelated retail customers and, with respect to a credit union or similar cooperative credit organisation, members, provided that no member has a greater than 5% interest in such credit union or cooperative credit organisation;

- The FFI must have no fixed place of business outside of country of incorporation or organisation other than a location that is not publicly advertised and from which the FFI performs solely administrative support functions;

- The FFI must not solicit customers or Account Holders outside the country of incorporation or organisation. Having a website will not cause a local bank to not meet this requirement as long as accounts cannot be opened on the website, the website does not indicate the FFI will maintain accounts for non-residents, and does not target US customers or account holders;

- The FFI must not have more than $175m in assets on its balance sheet and not more than $500m in total for a group of expanded affiliated group;

- With respect to a FFI that is part of an expanded affiliated group, each member is incorporated or organized in the same country and, with the exception of any member that is an Exempt Beneficial owner retirement fund or a FFI with only low-value accounts, meet the same requirements described above.

- Certified deemed-compliant sponsored, closely held investment vehicle — The requirements to qualify as a sponsored closely held investment vehicle (Certified deemed-compliant) are the following:

- The FFI must be a FFI solely because it is an Investment Entity and is not a qualified intermediary, withholding foreign partnership or withholding foreign trust;

- The FFI does not hold itself out as an investment vehicle for unrelated parties, and has 20 or fewer individuals that own its Debt and Equity Interests;

- The Sponsoring Entity is a US FI, Reporting Model 1 FFI or Participating FFI and is authorised to act on behalf of the FFI and agrees to perform on its behalf all due diligence, withholding and reporting responsibilities which would have arisen if the FFI were a Participating FFI;

- In addition, the Sponsoring Entity must:

- Register with the IRS as a sponsoring entity;

- Agree to undertake all FATCA compliance, withholding and reporting on behalf of the Sponsored entities and maintains all documentation for at least 6 years;

- Identify each sponsored FFI in all reporting completed on behalf of such sponsored FFI;

- Perform all verification procedures; and

- Not have its status as a sponsor revoked.

- Direct reporting NFFE means a NFFE that elects to report information about its direct or indirect substantial U.S. owners to the IRS and meets the following requirements:

- Registers with the IRS to obtain a GIIN;

- Report directly to the IRS on Form 8966 information about its substantial US owners (i.e., name, address, and TIN of each substantial US owner),payments made to the substantial US owners (including equity redemptions), value of each substantial US owner’s equity interest, information about the NFFE (i.e., name, address, and GIIN), and any other information required by Form 8966);

- Obtains a written certification (either on a withholding certificate or written statement) from each person that would be treated as a substantial US owner if such person were a specified US person. The written certification must indicate whether the person is a substantial US owner of the NFFE and if so, it must contain the name, address, and TIN of the person. If the NFFE has reason to know the certification is unreliable or incorrect and the owner does not correct the information within 90 days, the NFFE should report the person on a Form 8966;

- Keep records (for 6 years) that the NFFE produces in the ordinary course of its business that summarizes the activity relating to its transactions with respect to the equity of the NFFE held by each of its substantial US owners for any calendar year in which the owner was required to report;

- Respond to requests from the IRS about its substantial US owners;

- Make periodic certifications to the IRS within 6 months of each certification period (beginning 3 years after the issuance of the GIIN). Certification requires the officer of the NFFE to state the NFFE has not had any events of default, or if there was default, appropriate measures were taken to remediate such failures and prevent such failures from recurring, and for failures to report, the NFFE has corrected the filings; and

- Not had its direct reporting NFFE status revoked by the IRS

- Entity is an organisation, corporation, public sector entity, or business which is not a natural person or sole proprietor.

- Excepted nonfinancial entity in liquidation or bankruptcy refers to an entity that was not a financial institution or passive NFFE at any time during the past five years and is in the process of liquidating its assets or reorganizing with the intent to continue or recommence operations as a non-financial entity.

- Excepted nonfinancial start-up company refers to an entity that invests capital in assets with the intent to operate a business that is not a financial institution or passive NFFE. This status expires 24 months after the initial set-up of the entity and the FATCA documentation has to be renewed.

- Excepted territory NFFE refers to an entity that is not a financial institution, that is organised on U.S. territory (i.e. American Samoa, the Commonwealth of the Northern Mariana Islands, Guam, the Commonwealth of Puerto Rico, or the U.S. Virgin Islands), and all of the owners of the client are bona fide residents of that U.S. territory.

- Financial Institution (FI) refers to any entity that (i) accepts deposits in the ordinary course of a banking or similar business, (ii) holds financial assets for the account of others as a substantial portion of its business, or (iii) is engaged (or holding itself out as being engaged) primarily in the business of investing, reinvesting, or trading securities, partnership interests, commodities or similar financial instruments. The FATCA legislation contains an extensive definition, please refer to FATCA legislation for more information.

- Foreign Account Tax Compliance Act (FATCA) is enacted by the US Congress in March 2010 to target non-compliance by US taxpayers using foreign accounts. FATCA requires Foreign Financial Institutions (FFI) to report to the IRS information about financial accounts held by US taxpayers, or by foreign entities in which US taxpayers hold a substantial ownership interest.

- Foreign Financial Institution (FFI) refers to a non-US financial institution. The FATCA legislation contains an extensive definition of FFI and includes entities such as banks, custodian institutions, investment funds and certain types of insurance companies.

- Foreign government, government of a U.S. possession, or foreign central bank of issue refers to any government outside the U.S. including any political subdivision or wholly owned entities that are an integral part of the sovereign. It must not generate any income to the benefit of private persons.

- Intergovernmental Agreement (IGA) is a bilateral agreement signed between the US government and a foreign government regarding the implementation of FATCA. Broadly, these IGAs are categorised as either Model 1 or Model 2.

FFIs in Model 1 jurisdictions are required to report to the local tax authorities who in turn report to the US IRS whereas FFIs in Model 2 jurisdictions are required to report directly to the US IRS who in turn may choose to share the information with the respective Model 2 local tax authorities.

- Internal Revenue Service (IRS) is a US government agency responsible for tax collection and tax law enforcement.

- International organization refers to an organization or a wholly owned instrumentality or agency that either comprises primarily foreign governments, that is recognized as an intergovernmental or supranational organization by law, or that has a valid headquarters agreement with a government. It must not generate any income to the benefit of private persons.

- Non-Financial Foreign Entity (NFFE) is a non-US incorporated/established entity that does not meet the definition of an FFI (Foreign Financial Institution) and includes, but not limited to:

- Listed or privately held operating or trading businesses

- Professional service firms

- Certain entities with a passive trade (i.e. not an operating or trading business)

- Charitable organisations.

- Non-Participating FFI (NPFFI) is an FFI that is not a participating FFI, Reporting Model 1 FFI, Reporting Model 2 FFI, -compliant FFI, or an exempt beneficial owner.

- Nonprofit organisation refers to an entity established and maintained exclusively for religious, charitable, scientific, artistic, cultural or educational purposes that is exempt from income tax in its country of domicile and uses all funds for charitable purposes only.

- Non-reporting financial institution means any Financial Institution that is:

- A Governmental Entity, International Organisation or Central Bank, other than with respect to a payment that is derived from an obligation held in connection with a commercial financial activity of a type engaged in by a Specified Insurance Company, Custodial Institution, or Depository Institution;

- A Broad Participation Retirement Fund; a Narrow Participation Retirement Fund; a Pension Fund of a Governmental Entity, International Organisation or Central Bank; or a Qualified Credit Card Issuer;

- An Exempt Collective Investment Vehicle; or

- A Trustee-Documented Trust: a trust where the trustee of the trust is a Reporting Financial Institution and reports all information required to be reported with respect to all Reportable Accounts of the trust;

- Any other defined in a countries domestic law as a Non-Reporting Financial Institution.

- Nonreporting IGA FFI refers to an FFI that is a resident of, or located or established in, a Model 1 or Model 2 IGA jurisdiction that meets the requirements of:

- A nonreporting financial institution described in a specific category in Annex II of the Model 1 or Model 2 IGA;

- A registered deemed-compliant FFI described in Regulations section 1.1471-5(f)(1)(i)(A) through (F);

- A certified deemed-compliant FFI described in Regulations section 1.1471-5(f)(2)(i) through (v); or

- An exempt beneficial owner described in Regulations section 1.1471-6.

- Owner-documented FFI — An Owner-Documented FFI must meet the following requirements:

- Is a FFI solely because it is an investment entity;

- Must not be owned by, nor be a member of a group of an expanded affiliated group with any FI that is a Depository Institution, Custodial Institution or Specified Insurance Company;

- Does not maintain financial accounts for any Non-Participating FFIs;

- Must provide the required documentation and agree to notify designated withholding agent which is undertaking the reporting on behalf of the Owner Documented Financial Institution if there is a change in circumstances;

- The FI undertaking obligations on behalf of the Investment Entity must agree to report the information required on any Specified US Persons but will not need to report on any indirect owner of the owner documented entity that holds its interest through:

- A Participating FFI;

- Model 1 FFI;

- Deemed Compliant FFI (other than an Owner Documented FFI),

- Entity that is a US Person,

- Exempt Beneficial Owner,

- Excepted NFFE.

- Participating FFI is an FFI (including a reporting Model 2 FFI) that has registered with the IRS and agreed to comply with the terms of an FFI Agreement. It also includes a qualified intermediary (QI) branch of a U.S. financial institution, unless such branch is a reporting Model 1 FFI.

- Passive income refers to income generated from a passive activity, such as investments or a rental property or a business in which the taxpayer does not materially participate. Examples of passive income include dividends, interest, rents, royalties, and annuities.

- Passive NFFE means the entity is a non-U.S. entity that is not a financial institution and does not qualify as an Active NFFE.

- Publicly traded NFFE or NFFE affiliate of a publicly traded corporation refers to an entity that is not a financial institution whose stock is regularly traded on an established securities market or is a related entity (i.e. related by ownership greater than 50 percent) of an entity, the stock of which is regularly traded on an established securities market.

- Registered deemed-compliant FFI means: (1) an FFI that is registering to confirm that it meets the requirements to be treated as a local FFI, nonreporting FI member of a Participating FFI group, qualified collective investment vehicle, restricted fund, qualified credit card issuer, sponsored investment entity, or sponsored controlled foreign corporation (under Treasury Regulations section 1.1471-5(f)(1)(i)); (2) a Reporting FI under a Model 1 IGA and that is registering to obtain a GIIN; or (3) an FFI that is treated as a Nonreporting FI under a Model 1 or Model 2 IGA and that is registering pursuant to the applicable Model 1 or Model 2 IGA.

- Reporting Model 1 FFI refers to a non-US financial institution in a Model 1 IGA jurisdiction that performs account reporting to the jurisdiction’s government.

- Reporting Model 2 FFI refers to a non-US financial institution in a Model 2 IGA jurisdiction that has entered into an FFI agreement.

- Sole proprietor refers to an unincorporated business owned solely by an individual (natural person), generally.

- Specified US person means any US person other than:

- A corporation the stock of which is regularly traded on one or more established securities markets for a calendar year;

- Any corporation which is a member of the same expanded affiliated group as a corporation the stock of which is regularly traded on one or more established securities markets for the calendar year;

- Any organisation exempt from taxation under US federal tax law or an individual retirement plan;

- The United States or any wholly owned agency or instrumentality thereof;

- Any state, the District of Columbia, any US territory, any political subdivision of any of the foregoing, or any wholly owned agency or instrumentality of any one or more of the foregoing;

- Any bank incorporated and doing business under the laws of the United States (including laws relating to the District of Columbia) or of any state thereof;

- Any real estate investment trust;

- Any regulated investment company, or any entity registered with the Securities Exchange Commission under the Investment Company Act of 1940;

- Any common trust fund;

- Any trust that is exempt from tax or is deemed a charitable trust;

- A dealer in securities, commodities, or derivative financial instruments that is registered as such under the laws of the United States or any state;

- A broker;

- Any tax exempt trust under a tax exempt or public school annuity plan or governmental plan.

- Sponsored direct reporting NFFE means a Direct Reporting NFFE that has another entity, other than a nonparticipating FFI, that agrees to act as its Sponsoring Entity.

- Sponsored FFI refers to an FFI that is an investment entity or a controlled foreign corporation having a Sponsoring Entity that will perform the due diligence, withholding, and reporting obligations on its behalf.

- Stock Regularly Traded on an Established Securities Market

- (a) The term “established securities market” refers to an exchange that:

- is officially recognized and supervised by an authority in which the market is located; and

- has an annual value of shares traded on the exchange, exceeding US$1 billion during each of the three calendar years immediately preceding the calendar year in which the determination is being made (i.e. meaningful volume of trading).

- (b) Stock is deemed to be “regularly traded” if there is a meaningful volume of trading on an ongoing basis:

- (i) one or more classes of stock of the corporation that, in the aggregate, represent more than 50% of the total combined voting power of all classes of stock of such corporation entitled to vote and of the total value of the stock of such corporation are listed on such market(s) during the prior calendar year; and

- (ii) with respect to each class relied on to meet the more-than-50% listing requirement:

- trades in each such class are effected, other than in de minimis quantities, on such market(s) on at least 60 business days during the prior calendar year; and

- the aggregate number of shares in each such class that are traded on such market(s) during the prior year are at least 10% of the average number of shares outstanding in that class during the prior calendar year.

- Territory financial institution means a financial institution that is incorporated or organized under the laws of any U.S. territory, excluding a territory entity that is an investment entity but that is not a depository institution, custodial institution, or specified insurance company.

- US citizen refers to:

- An individual born in the United States

- An individual who has a parent who is a US citizen

- A former alien who has been naturalised as a US citizen

- An individual born in Puerto Rico

- An individual born in Guam

- An individual born in the US Virgin Islands.

- US person refers to:

- A citizen or resident of the United States

- A partnership created or organised in the United States or under the law of the United States or of any state, or the District of Columbia

- A corporation created or organised in the United States or under the law of the United States or of any state, or the District of Columbia

- Any estate or trust other than a foreign estate or foreign trust (see Internal Revenue Code section 7701(a)(31) for the definition of a foreign estate and a foreign trust)

- A person that meets the substantial presence test

- Any other person that is not a foreign person.

- US Tax Identification Number (TIN) is a unique identifier that is the Social Security Number (SSN) for US Person individuals and Employer Identification Number (EIN) for US Person entities.

- 501(c) organization — Section 501(c) entities are entities tax-exempt nonprofit organisation in the U.S. that obtained a 501(c) organisation status from the IRS. Some of the entities included in Section 501(c) include:

- Corporations Organised Under Act of Congress (including Federal Credit Unions)

- Religious, Educational, Charitable, Scientific, or Literary Organisations

- Civic Leagues, Social Welfare Organizations, and Local Associations of Employees

- Labor, Agricultural and Horticultural Organizations

- Business Leagues, Chambers of Commerce, Real Estate Boards, etc.

- Social and Recreational Clubs

- What are the consequences for failing to comply with FATCA?

Non-compliance potentially carries a penalty of a 30% withholding tax applied to withholdable payments received by the FFI. This penalty applies to not only the FFI’s own assets but also assets held for customers. Entities would be tagged as NPFFI and individuals would be tagged as recalcitrant.

Withholdable payments generally include, among other things:

- (a) S. dividend income and U.S. interest income paid after 30 June 2014; and

- (b) Gross proceeds from any sales occurring after 31 December 2018 of any property, such as U.S. stocks, U.S. Treasuries and other U.S. debt securities, that can produce U.S. dividends or U.S. interest income.

Generally, a recalcitrant account holder is any account holder that (1) fails to comply with reasonable requests for information necessary to determine if the account is a United States account; (2) fails to provide the name, address, and TIN of each “specified United States person” and each substantial United States owner of a United States owned foreign entity; or (3) fails to provide a waiver of any foreign law that would prevent a foreign financial institution from reporting information required under FATCA.

A resident alien is an individual that is not a citizen or national of the United States and who meets either the Green Card Test or the Substantial Presence Test for the calendar year. (For information regarding the Green Card Test or the Substantial Presence Test, you may refer to this link: https://www.irs.gov/individuals/international-taxpayers/the-green-card-test-and-the-substantial-presence-test )

A nonresident alien is an individual who is not a US citizen or a resident alien. A resident of a foreign country under the residence article of an income tax treaty is a nonresident alien individual for purposes of withholding.

- Under FATCA, a withholding agent is required to report information about substantial U.S. owners of a passive NFFE. Generally a Passive NFFE must provide a list of its substantial US owners on the Form W-8BEN-E or on a withholding statement provided with a Form W-8IMY.

Substantial U.S. owner — A substantial U.S. owner (as defined in Regulations section 1.1473-1(b)) means any specified U.S. person that:

- Owns, directly or indirectly, more than 10 percent (by vote or value) of the stock of any foreign corporation;

- Owns, directly or indirectly, more than 10 percent of the profits or capital interests in a foreign partnership;

- Is treated as an owner of any portion of a foreign trust under sections 671 through 679; or

- Holds, directly or indirectly, more than a 10 percent beneficial interest in a trust.

CRS Glossary

- Account Holder — is the person listed or identified as the holder of a Financial Account by the Financial Institution that maintains the account. This is regardless of whether such person is a flow-through Entity. Thus, for example, if a trust or an estate is listed as the holder or owner of a Financial Account, the trust or estate is the Account Holder, rather than the trustee or the trust’s owners or beneficiaries. Similarly, if a partnership is listed as the holder or owner of a Financial Account, the partnership is the Account Holder, rather than the partners in the partnership. A person, other than a Financial Institution, holding a Financial Account for the benefit or account of another person as agent, custodian, nominee, signatory, investment advisor, or intermediary, is not treated as holding the account, and such other person is treated as holding the account.

- Active NFE — an NFE that meets any of the criteria listed below:

- (a) less than 50% of the NFE’s gross income for the preceding calendar year or other appropriate reporting period is passive income and less than 50% of the assets held by the NFE during the preceding calendar year or other appropriate reporting period are assets that produce or are held for the production of passive income;

- (b) the stock of the NFE is regularly traded on an established securities market or the NFE is a Related Entity of an Entity the stock of which is regularly traded on an established securities market;

- (c) the NFE is a Governmental Entity, an International Organisation, a Central Bank, or an Entity wholly owned by one or more of the foregoing;

- (d) substantially all of the activities of the NFE consist of holding (in whole or in part) the outstanding stock of, or providing financing and services to, one or more subsidiaries that engage in trades or businesses other than the business of a Financial Institution;

- (e) the NFE is not yet operating a business and has no prior operating history, (a “ start-up NFE”) but is investing capital into assets with the intent to operate a business other than that of a Financial Institution, This exception is limited to 24 months from the date of the initial organisation of the NFE;

- (f) the NFE was not a Financial Institution in the past five years, and is in the process of liquidating its assets or is reorganising with the intent to continue or recommence operations in a business other than that of a Financial Institution;

- (g) the NFE primarily engages in financing and hedging transactions with, or for, Related Entities that are not Financial Institutions, and does not provide financing or hedging services to any Entity that is not a Related Entity, provided that the group of any such Related Entities is primarily engaged in a business other than that of a Financial Institution; or

- (h) the NFE meets all of the following requirements for a “non-profit NFE”:

- (i) is established and operated in its jurisdiction of residence exclusively for religious, charitable, scientific, artistic, cultural, athletic, or educational purposes; or it is established and operated in its jurisdiction of residence and it is a professional organisation, business league, chamber of commerce, labour organisation, agricultural or horticultural organisation, civic league or an organisation operated exclusively for the promotion of social welfare;

- (ii) is exempt from income tax in its jurisdiction of residence;

- (iii) has no shareholders or members who have a proprietary or beneficial interest in its income or assets;

- (iv) the applicable laws of the NFE’s jurisdiction of residence or the NFE’s formation documents do not permit any income or assets of the NFE to be distributed to, or applied for the benefit of, a private person or non-charitable Entity; and

- (v) the applicable laws of the NFE’s jurisdiction of residence or the NFE’s formation documents require that, upon the NFE’s liquidation or dissolution, all of its assets be distributed to a Governmental Entity or other non-profit organisation, or escheat to the government of the NFE’s jurisdiction of residence or any political subdivision.

In summary, these criteria refer to:

- active NFEs by reason of income and assets;

- publicly traded NFEs;

- Governmental Entities, International Organisations, Central Banks, or their wholly owned Entities;

- holding NFEs that are members of a nonfinancial group;

- start-up NFEs;

- NFEs that are liquidating or emerging from bankruptcy;

- treasury centres that are members of a nonfinancial group; or

- non-profit NFEs.

Note: Certain entities (such as U.S. Territory NFFEs) may qualify for Active NFFE status under FATCA but not Active NFE status under the CRS.

- Citizenship by Investment (CBI) and Residence by Investment (RBI), endorsed by the OECD on 16th October 2018, are schemes offered by a substantial number of jurisdictions allowing foreign individuals to obtain citizenship, temporary or permanent residence rights on the basis of local investments or against a flat fee. The OECD has analyzed over 100 CBI/RBI schemes, offered by CRS-committed jurisdictions, which potentially pose a high-risk to the integrity of CRS. The list of such CBI/RBI schemes is updated on an ongoing basis by the OECD (https://www.oecd.org/tax/automatic-exchange/crs-implementation-and-assistance/residence-citizenship-by-investment/) .

- Control — is generally exercised by the natural person(s) who ultimately has a controlling ownership interest (typically on the basis of a certain percentage (e.g., 25%)) in the Entity. Where no natural person(s) exercises control through ownership interests, the Controlling Person(s) of the Entity will be the natural person(s) who exercises control of the Entity through other means (for purposes of determining the controlling ownership interest, the domestic implementation of the FATF Recommendations and of the AML/KYC Procedures pursuant to the anti-money laundering or similar requirements to which the Reporting Financial Institution is subject shall apply). Where no natural person(s) is/are identified as exercising control of the Entity through ownership interests (for example where no underlying person has control of greater than 25% of the entity), then under the CRS the Reportable Person is deemed to be the natural person who holds the position of senior managing official. Please note that the aforementioned conditions for determining who exercises control over an Entity need to be followed in sequential order.

- Controlling Person(s) — natural person(s) who exercise control over an entity. Where that entity is treated as a Passive Non-Financial Entity (“Passive NFE”) then a Financial Institution is required to determine whether or not these Controlling Persons are Reportable Jurisdiction Persons. This definition corresponds to the term “beneficial owner” of an entity as described in Recommendation 10 (and the Interpretative Note) of the Financial Action Task Force (FATF) recommendations, as adopted in February 2012.

In the case of a trust, the Controlling Person(s) are the settlor(s), the trustee(s), the protector(s) (if any), and the beneficiary(ies) or class(es) of beneficiaries, regardless of whether or not any of them exercises control over the activities of the trust. In addition, any other natural person(s) exercising ultimate effective control over the trust (including through a chain of control or ownership) is a Controlling Person of a trust.

Where the settlor(s) of a trust is an Entity then the CRS requires Financial Institutions to also identify the Controlling Persons of the settlor(s) and when required report them as Controlling Persons of the trust.

In the case of a legal arrangement other than a trust, “Controlling Person(s)” means persons in equivalent or similar positions.

- Custodial Institution — means any Entity that holds, as a substantial portion of its business, Financial Assets for the account of others. This is where the Entity’s gross income attributable to the holding of Financial Assets and related financial services equals or exceeds 20% of the Entity’s gross income during the shorter of: (i) the three-year period that ends on 31 December (or the final day of a non-calendar year accounting period) prior to the year in which the determination is being made; or (ii) the period during which the Entity has been in existence.

- Depository Institution — means any Entity that accepts deposits in the ordinary course of a banking or similar business.

- Entity — a legal person or a legal arrangement, such as a corporation, organisation, partnership, trust or foundation. This term covers any person other than an individual (i.e., a natural person).

- Financial Account — an account maintained by a Financial Institution and includes: Depository Accounts, Custodial Accounts; Equity and debt interests in certain Investment Entities, Cash Value Insurance Contracts; and Annuity Contracts.

- Financial Institution — a Custodial Institution, a Depository Institution, an Investment Entity, or a Specified Insurance Company. Please see the relevant domestic guidance and the CRS for further classification definitions that apply to Financial Institutions.

- Investment Entity — includes two types of Entities:

- (i) an Entity that primarily conducts as a business one or more of the following activities or operations for or on behalf of a customer:

- Trading in money market instruments (cheques, bills, certificates of deposit, derivatives, etc.); foreign exchange; exchange, interest rate and index instruments; transferable securities; or commodity futures trading;

- Individual and collective portfolio management; or

- Otherwise investing, administering, or managing Financial Assets or money on behalf of other persons.

However, such activities or operations do not include rendering non-binding investment advice to a customer.

- (ii) The second type of “Investment Entity” (“Investment Entity managed by another Financial Institution”) is any Entity the gross income of which is primarily attributable to investing, reinvesting, or trading in Financial Assets where the entity is managed by another entity that is a Depository Institution, a Custodial Institution, a specified Insurance Company or an Investment Entity described in (i) above.

- Investment Entity located in a Non-Participating Jurisdiction and managed by another Financial Institution — means any Entity the gross income of which is primarily attributable to investing, reinvesting, or trading in Financial Assets if the Entity is (i) managed by a Financial Institution and (ii) not a Participating Jurisdiction Financial Institution.

- Investment Entity managed by another Financial Institution — An Entity is “managed by” another Entity if the managing Entity performs, either directly or through another service provider on behalf of the managed Entity, any of the activities or operations described in clause (i) above in the definition of ‘Investment Entity’.

An Entity only manages another Entity if it has discretionary authority to manage the other Entity’s assets (either in whole or part). Where an Entity is managed by a mix of Financial Institutions, NFEs or individuals, the Entity is considered to be managed by another Entity that is a Depository Institution, a Custodial Institution, a Specified Insurance Company, or the first type of Investment Entity, if any of the managing Entities is such another Entity.

- NFE —any Entity that is not a Financial Institution.

- Non-Reporting Financial Institution — means any Financial Institution that is:

- a Governmental Entity, International Organisation or Central Bank, other than with respect to a payment that is derived from an obligation held in connection with a commercial financial activity of a type engaged in by a Specified Insurance Company, Custodial Institution, or Depository Institution;

- a Broad Participation Retirement Fund; a Narrow Participation Retirement Fund; a Pension Fund of a Governmental Entity, International Organisation or Central Bank; or a Qualified Credit Card Issuer;

- any other Entity that presents a low risk of being used to evade tax, has substantially similar characteristics to any of the Entities described in above parts (i) and (ii), and is defined in a country’s domestic law as a Non-Reporting Financial Institution, provided that the status of such Entity as a Non-Reporting Financial Institution does not frustrate the purposes of the Common Reporting Standard;

- a Trustee-Documented Trust: a trust where the trustee of the trust is a Reporting Financial Institution and reports all information required to be reported with respect to all Reportable Accounts of the trust;

- an Exempt Collective Investment Vehicle; or

- any other defined in a countries domestic law as a Non-Reporting Financial Institution.

- Participating Jurisdiction — A jurisdiction (i) with which an agreement is in place pursuant to which it will provide the information set out in the CRS and required for the automatic exchange of financial account information, and (ii) which is identified in a published list. (You may refer to this link for the list: https://www.iras.gov.sg/irashome/uploadedFiles/IRASHome/Quick_Links/International_Tax/List%20of%20Participating%20Jurisdictions_2019.pdf )

- Participating Jurisdiction Financial Institution — means (i) any Financial Institution that is tax resident in a Participating Jurisdiction, but excludes any branch of that Financial Institution that is located outside of that jurisdiction, and (ii) any branch of a Financial Institution that is not tax resident in a Participating Jurisdiction, if that branch is located in such Participating Jurisdiction.

- Passive NFE — under the CRS any: (i) NFE that is not an Active NFE; and (ii) Investment Entity located in a Non-Participating Jurisdiction and managed by another Financial Institution.

- Related Entity — An Entity is related to another Entity if either Entity controls the other Entity or the two Entities are under common control. For this purpose, control includes direct or indirect ownership of more than 50% of the vote and value in an Entity.

- Reportable Account — a financial account held by one or more Reportable Persons or by a Passive NFE with one or more Controlling Persons that is/are a Reportable Person(s), provided it has been identified as such pursuant to the CRS due diligence procedures.

Under the CRS Regulations, a Reportable Account will also include an undocumented account which refers to a pre‑existing account where —

- the Account Holder is an individual;

- the Reporting SGFI that maintains the account does not have any indicia other than a hold mail or in‑care‑of address; and

- the Reporting SGFI is unable to obtain any Documentary Evidence, or valid self‑certification from the Account Holder to establish the Account Holder’s residence for tax purposes.

Please note that determining whether an account is a Reportable Account is subject to provisions in different countries’ domestic laws.

- Reportable Jurisdiction — a jurisdiction (i) with which an agreement is in place pursuant to which there is an obligation to provide financial account information set forth in the CRS, and (ii) which is identified in a published list. (You may refer to this link for the List of Reportable Jurisdiction for Singapore: https://www.iras.gov.sg/irashome/uploadedFiles/IRASHome/Quick_Links/International_Tax/List%20of%20Reportable%20Jurisdictions_2018%20CRS%20reporting_wef%206%20Mar%2019.pdf For other countries, please refer to that specific country’s reporting obligations.)

- Reportable Jurisdiction Person — means an individual or Entity that is resident in a Reportable Jurisdiction(s) under the local tax laws of such jurisdiction, or an estate of a decedent who was a resident of a Reportable Jurisdiction. Generally, an entity will be resident for tax purposes in a jurisdiction, if under the tax laws of that jurisdiction (including tax conventions), it pays or should be paying tax therein by reason of its domicile, residence, place of management or incorporation or any other criterion of a similar nature, and not only from sources in that jurisdiction. An Entity such as a partnership, limited liability partnership or similar legal arrangement that has no residence for tax purposes shall be treated as resident in the jurisdiction in which its place of effective management is situated. If another type of Entity certifies that it has no residence for tax purposes it should complete the CRS Self-certification stating the address of its principal office. Dual resident Entities may rely on the tiebreaker rules contained in tax conventions (if applicable) to determine their residence for tax purposes. Please note that determining whether an individual or entity is a Reportable Jurisdiction Person is subject to provisions in different countries’ domestic laws.

- Reportable Person — is a “Reportable Jurisdiction Person”, other than:

- a corporation the stock of which is regularly traded on one or more established securities markets;

- any corporation that is a Related Entity of a corporation described immediately above;

- a Governmental Entity;

- an International Organisation;

- a Central Bank; or

- a Financial Institution (except for an Investment Entity that is not a Participating Jurisdiction Financial Institution, which is treated as a Passive NFE’.)

- Resident for tax purposes / Jurisdiction of Residence — generally means resident for tax purposes in a particular jurisdiction if, under the laws of that jurisdiction (including tax conventions), it pays or should be paying tax therein by reason of his domicile, residence, place of management or incorporation, or any other criterion of a similar nature, and not only from sources in that jurisdiction. An Entity such as a partnership, limited liability partnership or similar legal arrangement that has no residence for tax purposes shall be treated as resident in the jurisdiction in which its place of effective management is situated. For additional information on tax residence, please contact your tax adviser or use the OECD AEOI Portal containing information on tax residence in Participating Jurisdictions at oecd.org/tax/automatic-exchange/crs-implementation-and-assistance/

- Specified Insurance Company — any Entity that is an insurance company (or the holding company of an insurance company) that issues, or is obligated to make payments with respect to, a Cash value Insurance Contract or an Annuity contract.

- TIN — the Taxpayer Identification Number or a functional equivalent in the absence of a TIN. A TIN is a unique combination of letters or numbers assigned by a jurisdiction to an individual or an Entity and used to identify the individual or Entity for the purposes of administering the tax laws of such jurisdiction. Some jurisdictions do not issue a TIN. However, these jurisdictions often utilise some other high integrity number with an equivalent level of identification (a “functional equivalent”). Examples of that type of number include, for Entities, a Business/company registration code/number.

- You may refer to this link for more information regarding TIN: http://www.oecd.org/tax/automatic-exchange/crs-implementation-and-assistance/tax-identification-numbers/#d.en.347759

You may refer to this link for more information regarding tax residency rules: http://www.oecd.org/tax/automatic-exchange/crs-implementation-and-assistance/tax-residency/