Hong Kong – Tuesday, 15 September 2015 CLSA Limited (CLSA), Asia’s leading and longest-running brokerage and investment group, launches today at the 22nd CLSA Investors’ Forum, a series of reports that examine China’s One Belt, One Road strategy a year since it was launched.

Published jointly with CITIC Securities (CITICS), the OBOR: Silk Belt and Sea Road reports assess the countries, sectors and companies that will benefit most from China’s ‘brilliant plan’ to connect Asia and Europe by borrowing the concept of the historical Silk Road. The Silk Road Economic Belt (One Belt) aims to build infrastructure to ensure a long-term presence for China in Eurasian countries and the 21st Century Maritime Silk Road (One Road) plans to build ports and maritime facilities from the Pacific Ocean to the Baltic Sea.

CLSA and CITICS believe OBOR will have a long-term impact on China and the region and enable China to export its overcapacity in steel, cement and aluminum, establish strategic geo-political alliances, harness energy security and form a giant new free-trade zone. OBOR provides an infrastructure plan that could accelerate and rationalise national development for trade and urbanisation.

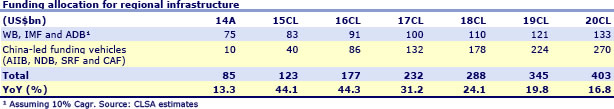

While each province in China has its own OBOR plan and will benefit, OBOR will have a significant impact regionally. Countries requiring funds for their infrastructure build out will benefit also, as will regional infrastructure companies. CLSA and CITICS’ research indicates that third party annual infrastructure loan quotas will increase from c.US$75bn to US$400bn p.a over the next five years.

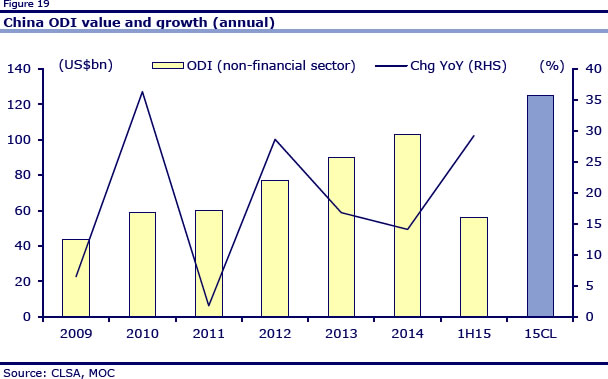

Chinese conglomerates have the expertise, scale and resources to be the main contractors but regional collaboration will help local implementation and ensure sustainability for operational assets. Public-Private Partnership (PPP) in the form of cross-border BT and BOT will become one of the key models for G2G infrastructure projects and China’s non-financial ODI could increase from US$103bn to US$200bn (by 2020) for Greenfield, M&A and joint-ventures.

CLSA and CITICS screened 285 companies in the region to identify 33 potential beneficiaries of the plan. Fourteen companies were rated as Buys and their combined portfolio could generate 50% total shareholder return (TSR) over the next 12-24 months.

CLSA’s Head of China Industrial Research, Alexious Lee, highlights six charts from the OBOR: Silk Belt and Sea Road strategy report which highlight the potential of the OBOR strategy.

Asset (loan) allocation will shift in favour of infrastructure development in Asia to increase from US$75bn (2014) to US$400bn (fcst’ed in 2020)

1. China is repositioning itself as a “one-stop-shop” to drive more G2G projects, and US$162bn have been signed over the last 12 months.

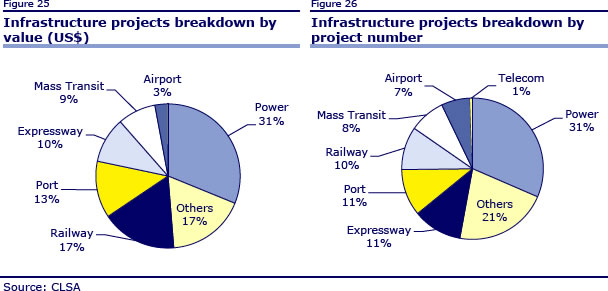

2. Based on our review of 365 of the projects in the region, we understand the project mix as below and who should benefit…

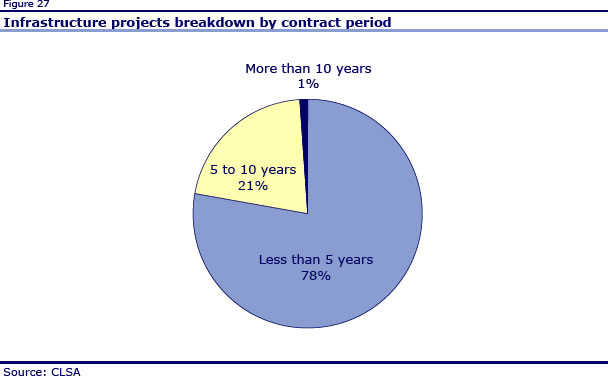

3. Then we analyze their project tenure and realized that overseas project is about 5-6 years long versus 4-5 years in China. So that we know how to forecast our revenue

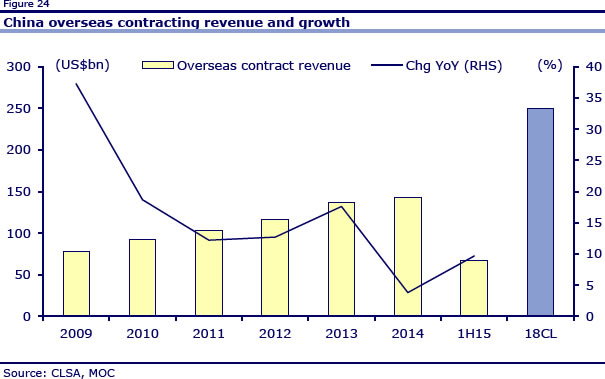

4. China’s overseas contracting revenue and growth started to accelerate in 1H15

5. Regional economies are potential beneficiaries because other than infra-loans, China’s ODI to their Sino-collaborated partners will jump.