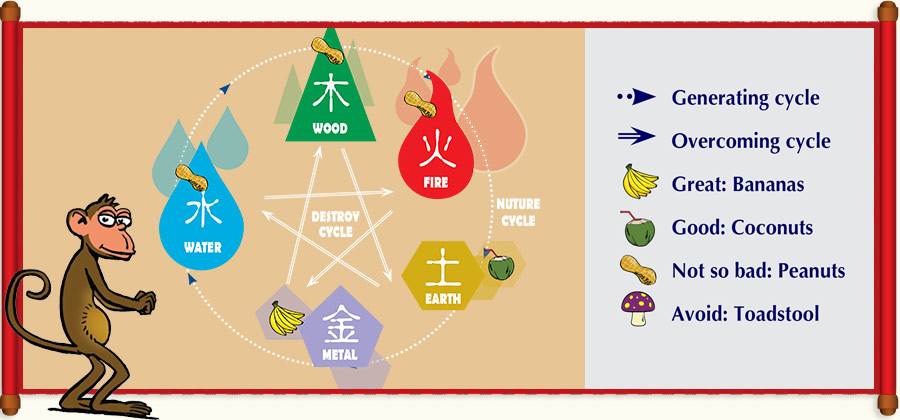

This year is going to get better. Shipping, banking, gambling and retail will all make good ground. We happily announce that philosophy and arcane studies belong to water and that their tide is rising - good for all of us, even if these stocks are not listed.

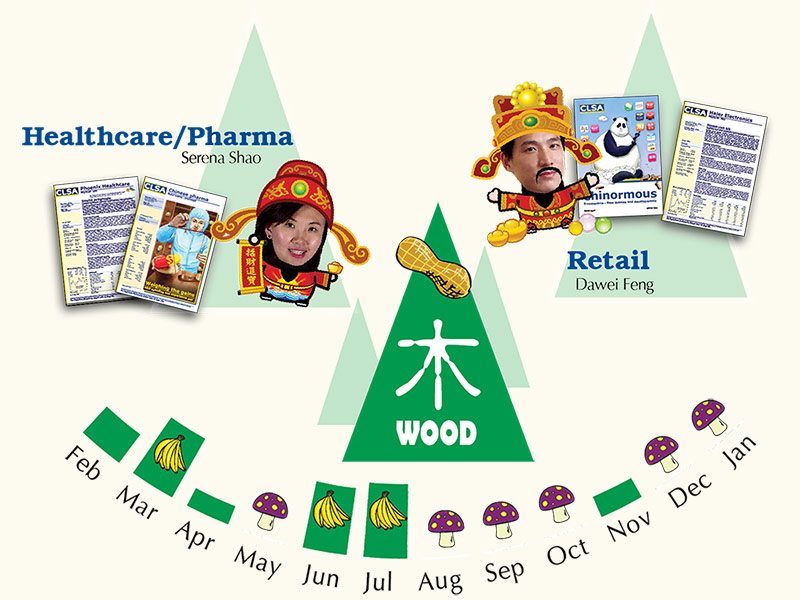

From wood come the paper and lumber industries as well as timepieces, hairdressers and ingredients for medicine and the like. This year may not be as good as the last, but there are still some good trees in this forest.

It’s a fire year, but other elements are going to weigh it down. Nonetheless, no-one should lemur as there is much to look forward to. Telecoms and computing should not be making monkeys out of their supporters. Cosmetics, glasses and advertising may well come trooping in.

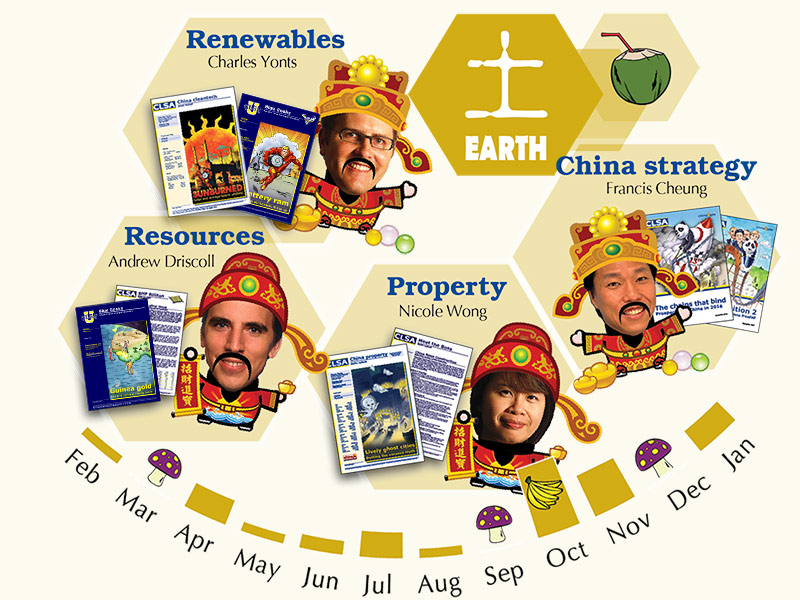

From our planet there is nothing to go ape over. From earth come construction, both buildings and capital, livestock rearing and real estate, all of which may not go baboon but should fare well. Leather and hotels are well indicated so expect some activity from right-wing politicians as they indulge in their primate sensibilities.

It is not only gold and silver that should thrive this year - think autos and machinery (good for monkey-bar makers); lawyers (always monkeying around); martial arts (the drunken monkey form anyone?); and public servants (nah, can’t think of any monkey-associated terms for them).