Coal

Shift from capacity shutdowns to consolidation

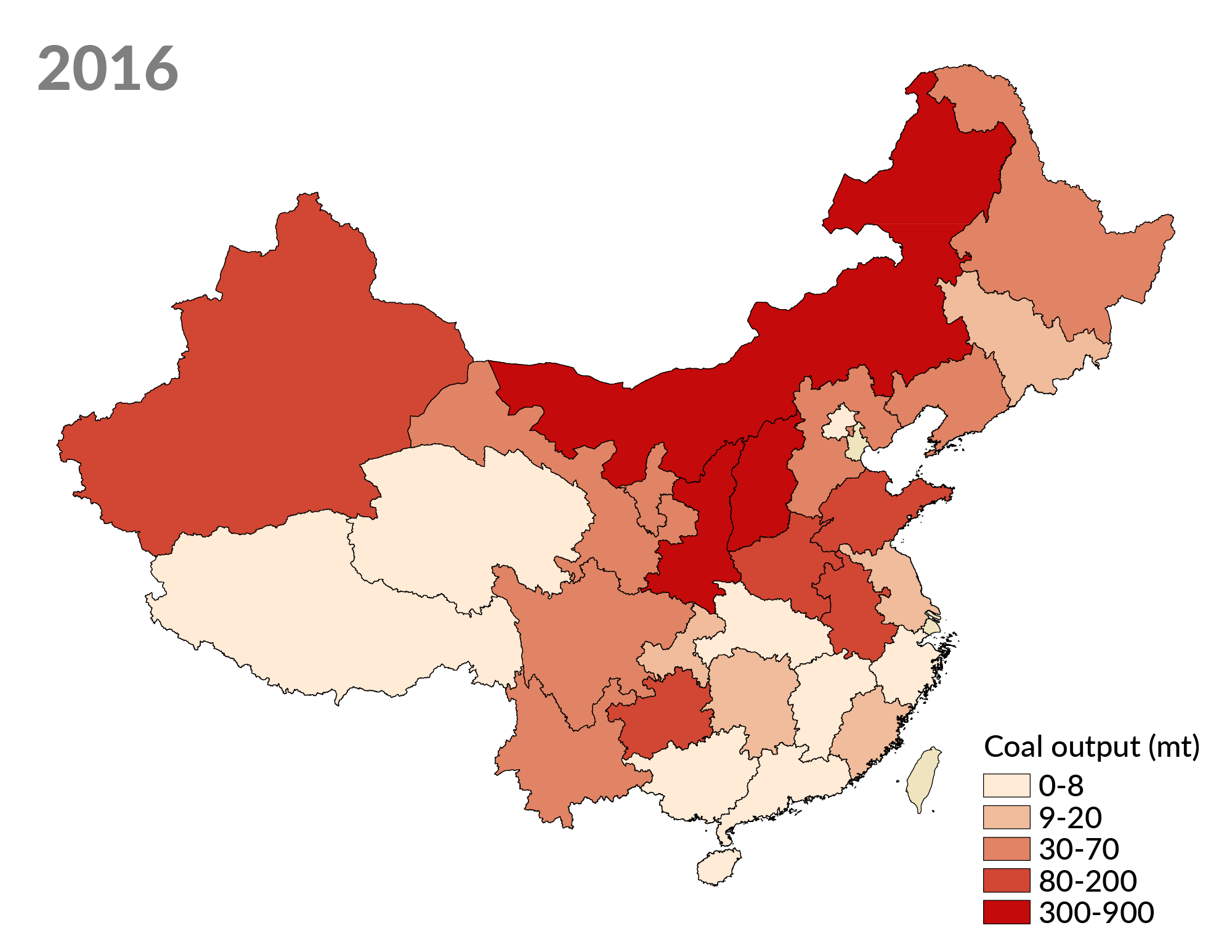

Coal production is geographically concentrated in the north and west. Provinces in the central and eastern portions of China will decrease or stop mining.

By 2020, 95% of coal output will be concentrated in 14 key production bases. CLSA estimates coal capacity will fall 14.3% between 2015-20 to 4,800mt by 2020.

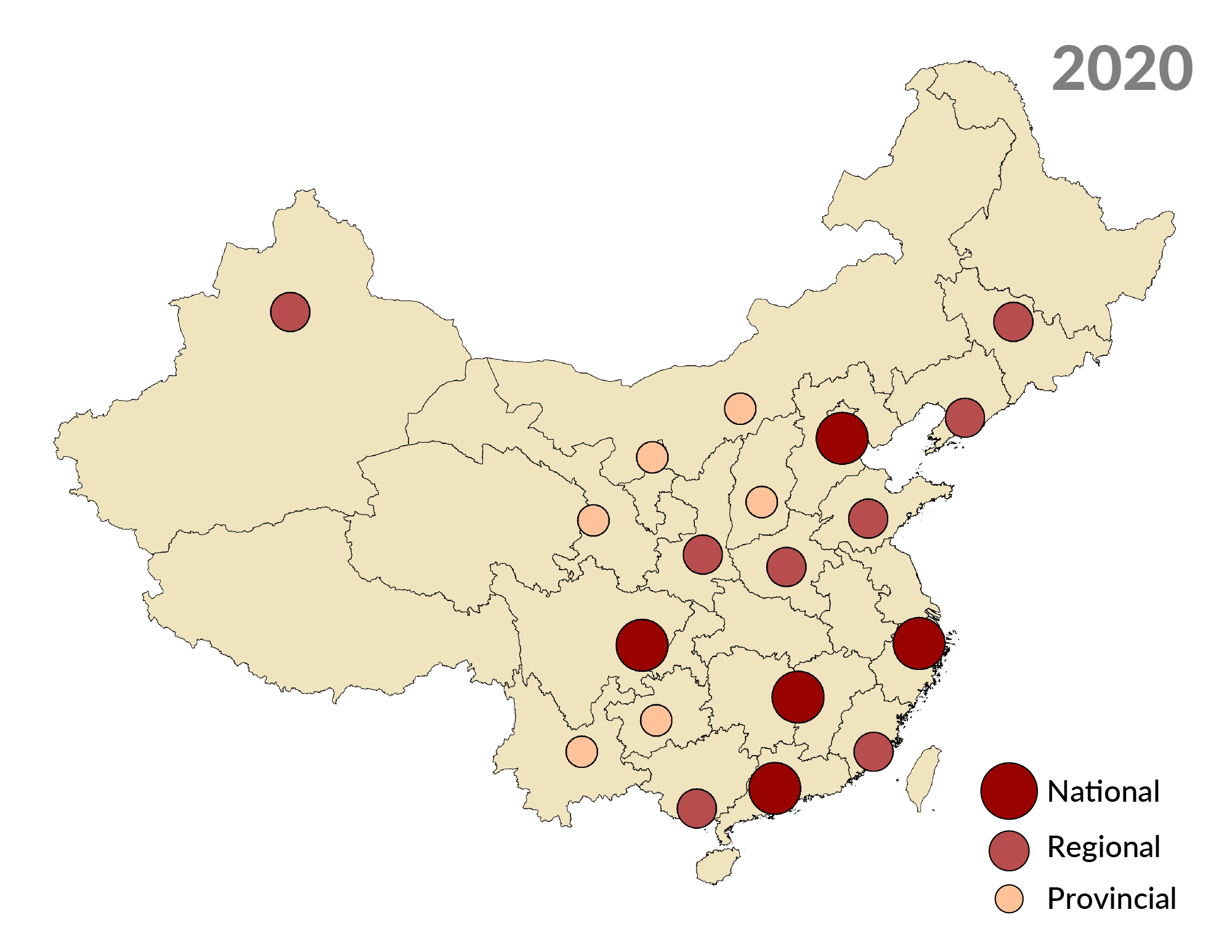

Grid

Increased investment addresses poor grid access

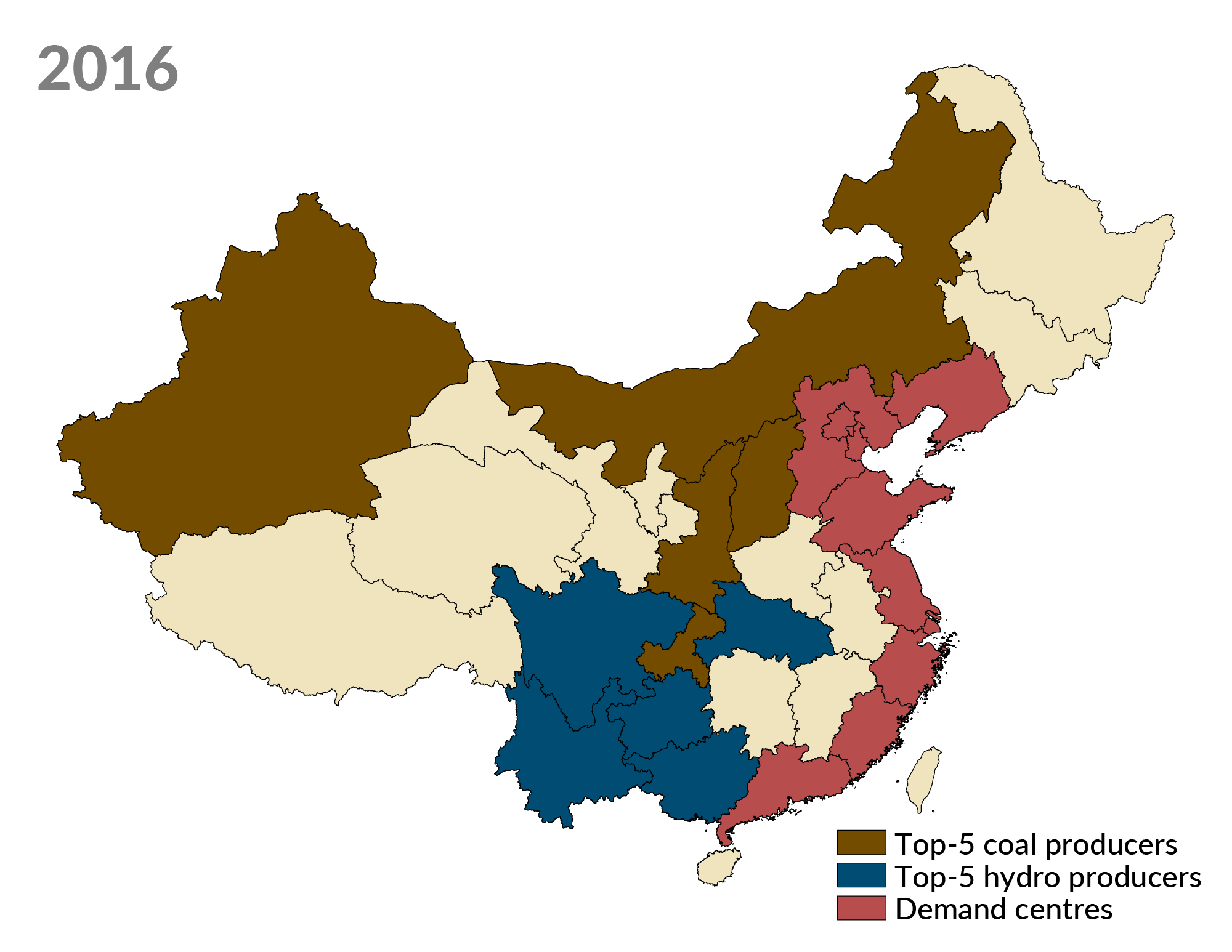

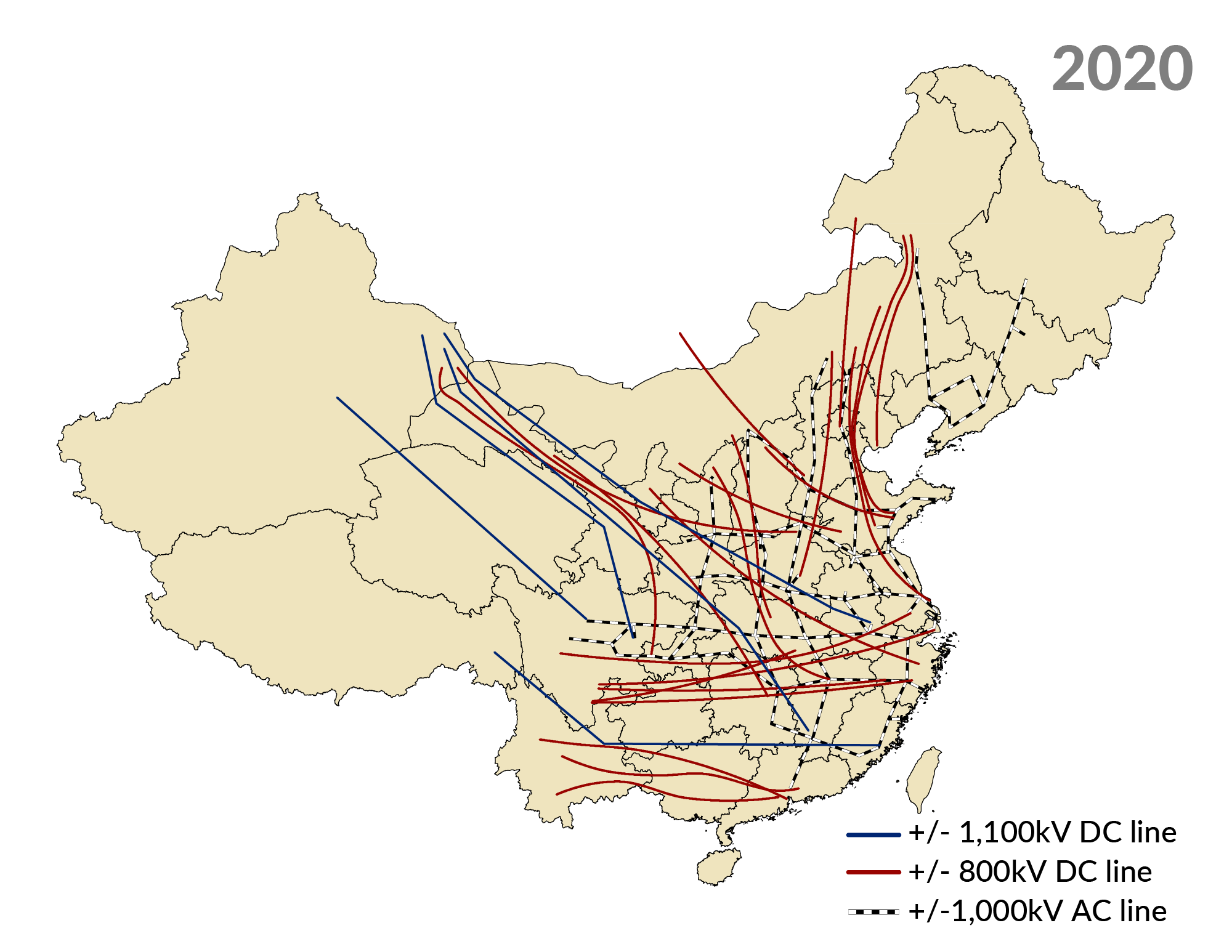

China's energy resources are concentrated in the north and west, far from demand centres on the coast.

Ultra-high-voltage (UHV) power will address poor grid access and form the backbone of trans-provincial power transmission. West to east transmission capacity will increase from 130GW to 270GW.

Natural gas

Bigger share of energy production

As a cleaner burning energy source, natural gas better fits China's environmental agenda and is also flexible in meeting peak demand. However, import and distribution networks remain relatively underbuilt.

Natural gas's share of energy consumption will increase to 10% by 2020. Investment will focus on increasing imports and consumer and industrial usage via 53,000km of transnational and municipal projects.

CLSA estimates intake terminal capacity will need to almost double, from 40mt in 2015 to 77mt in 2020.

Hydro

Pumped storage takes priority

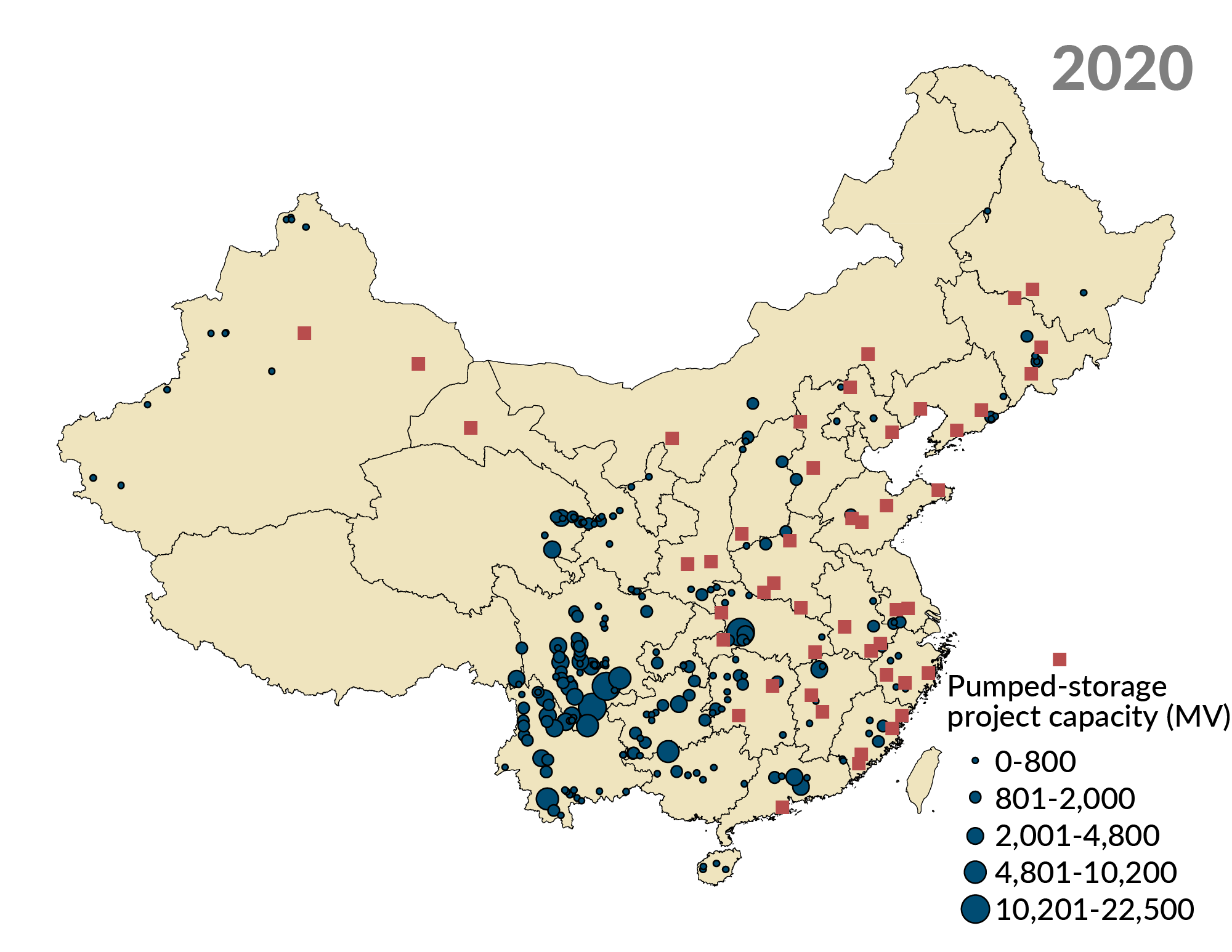

China's hydro boom has taken place in the southwest of the country. Capacity increased 330% from 2000 to 2017. It is the second-most significant source of energy, accounting for 19% of power output in 2017.

Pumped-storage hydropower will expand rapidly. These projects can be built close to demand centres and directly address the energy storage and curtailment issues plaguing renewables.

China’s National Development and Reform Commission (NDRC) targets adding 44GW of conventional hydro capacity for a total of 340GW and 17GW of pumped-storage capacity for a total of 40GW.

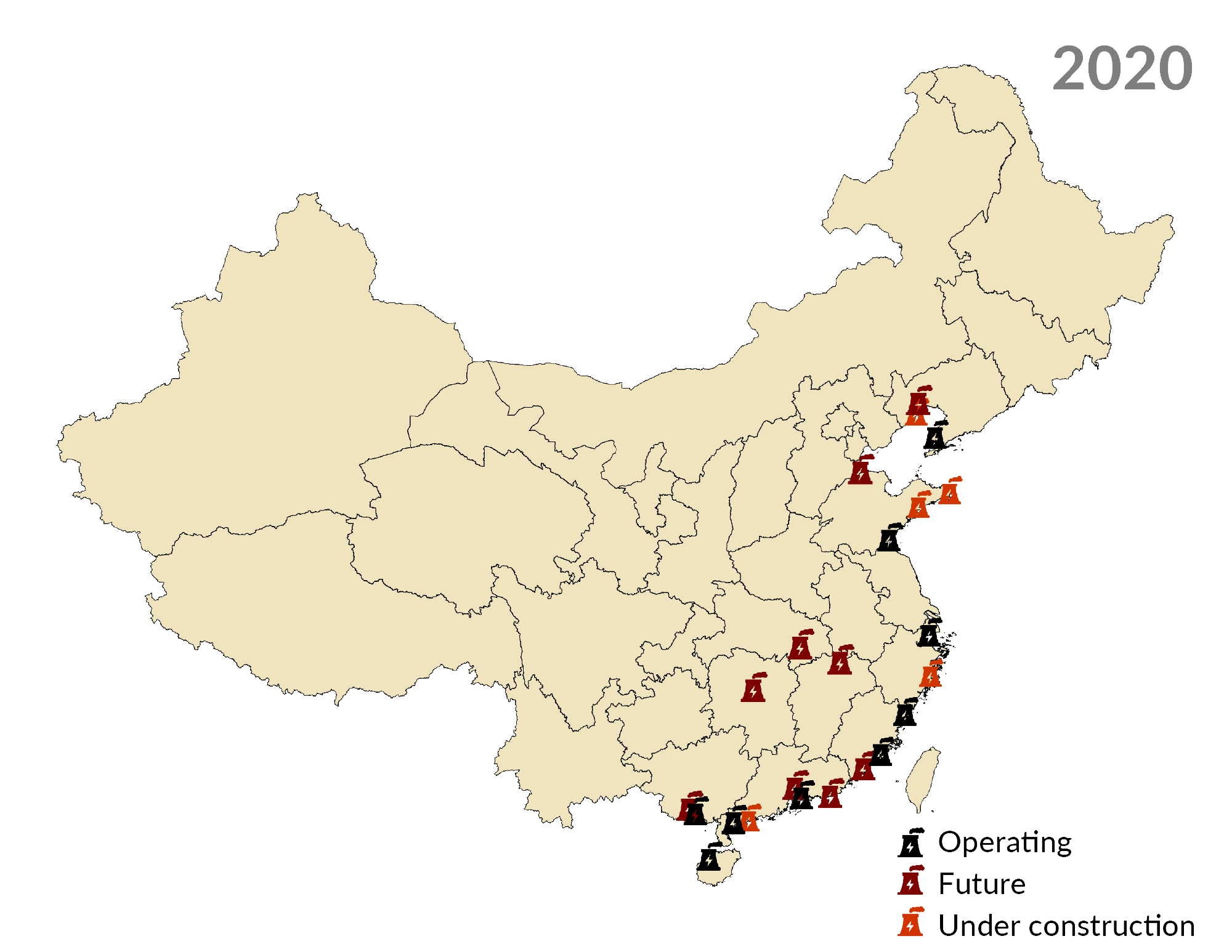

Nuclear

Steady growth trajectory

The number of reactors in China has grown more than tenfold since 2000. While China now leads the world in nuclear capacity, it still only accounts for 3.9% of the country's electricity production.

Nuclear will continue its steady growth trajectory. It is an efficient and flexible power source that can be built close to demand centres on the coast.

The NDRC targets to approve six to eight nuclear reactors; 58GW of capacity has been completed, with 30GW under construction.

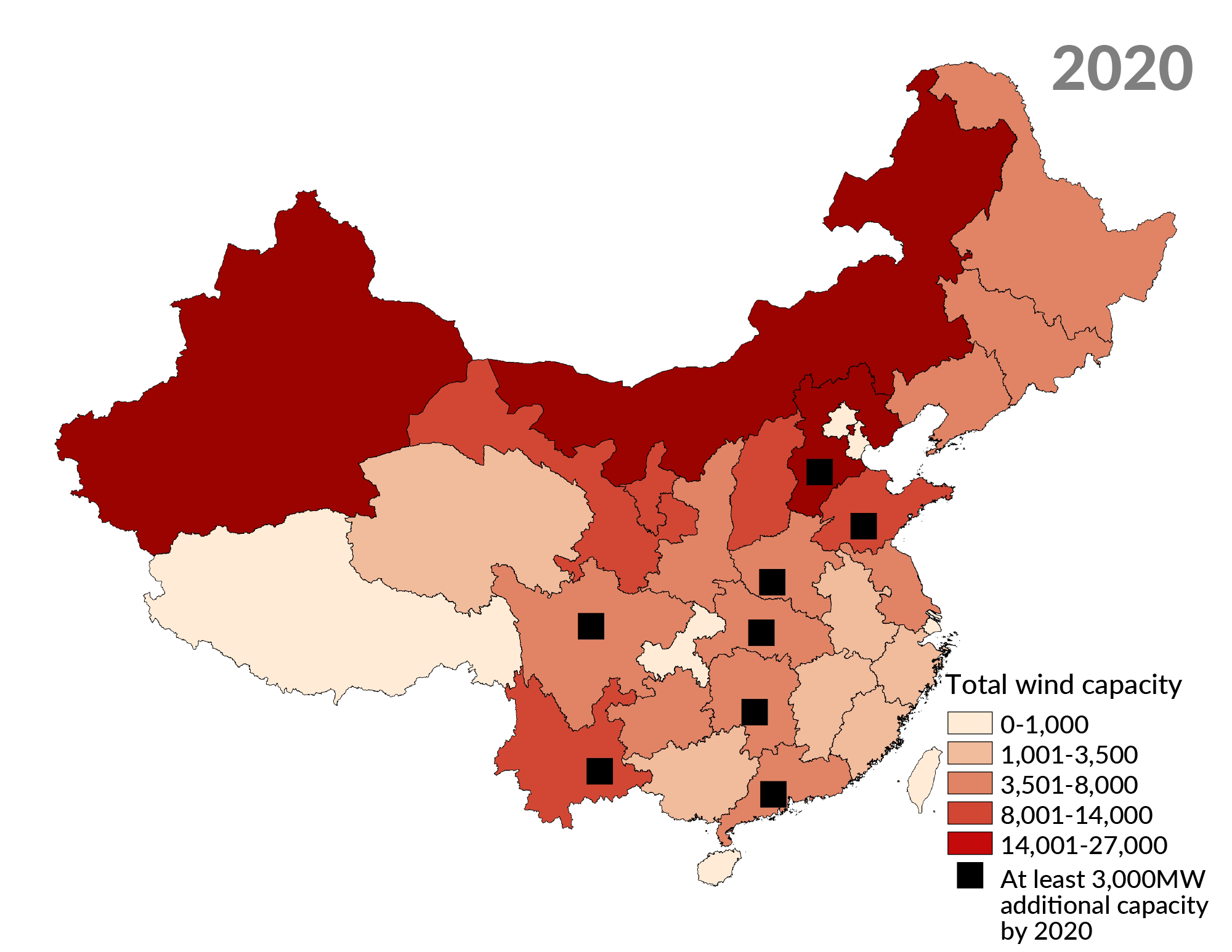

Wind

Ahead of the curve

Wind-farm construction is concentrated in large development bases in the north and west, resulting in a rapid increase in capacity. Wind accounted for 4.8% of power production in 2017.

China is on pace to easily surpass its 210GW capacity goal set by the NDRC for 2020. Highlighted provinces will add at least 3,000MW of capacity from 2017 to 2020.

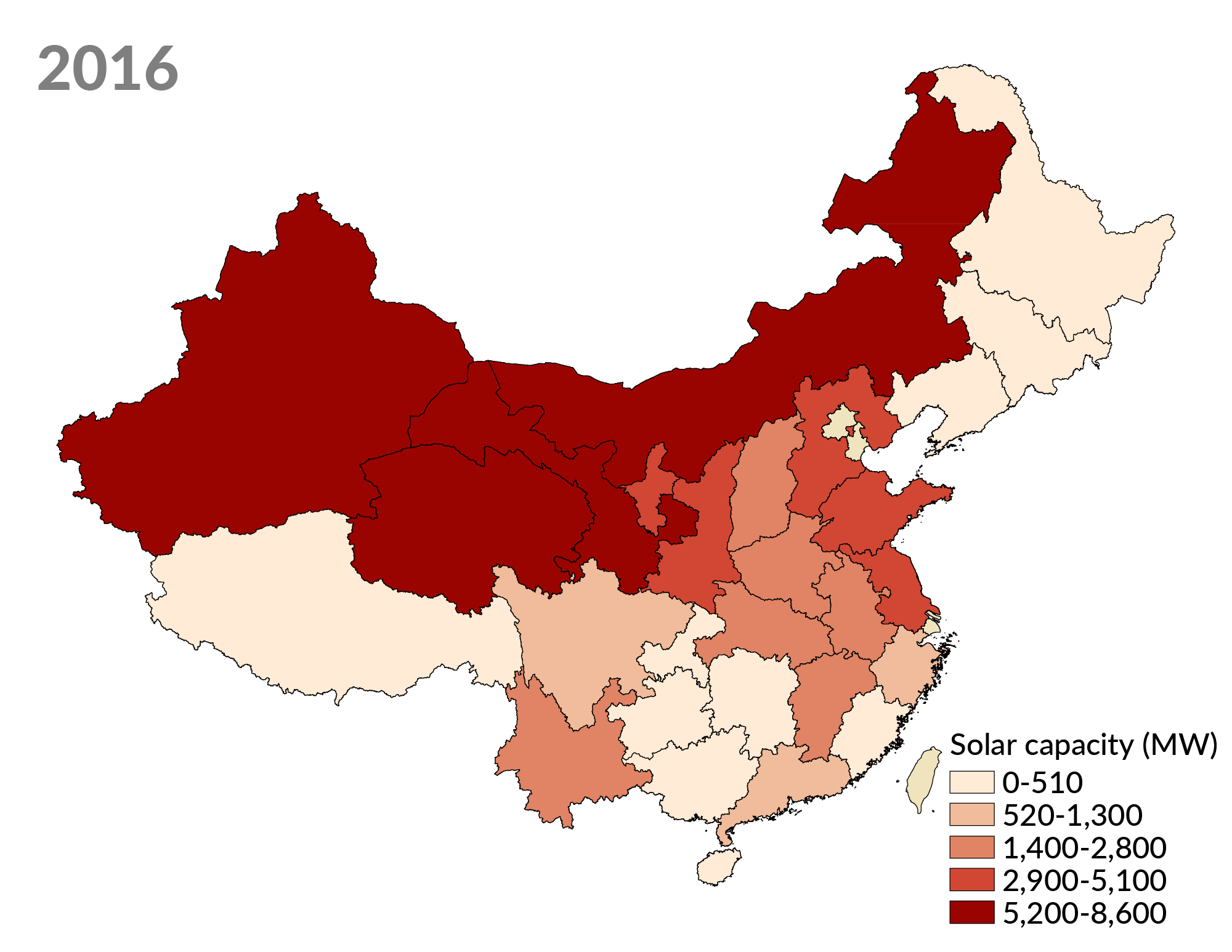

Solar

Increased focus on localised distribution

Solar accounted for 1.8% of power production in 2017. As of 2018, the NDRC's 70GW target of new solar capacity during the 13th Five Year Plan has already been achieved.

Substantial efforts are being made to ease the geographic challenges that renewables face by shifting UHV line construction nearer to demand centres in central and eastern China. There is an increased focus on localised distributed solar projects to help alleviate poverty. Solar panels will be installed on 2.8m rural homes by 2020.

High-speed rail

Cross-regional development

Between 2008-16, China increased its high-speed-rail network from zero to 22,000km, accounting for 60% of the world total.

By 2020, 80% of major cities should be linked via high-speed rail. The NDRC estimates Rmb3.5tn of investment will be needed to complete 11,000km of new track, representing 58% network growth.

Urban rail

Putting down tracks

Only 12 Chinese cities had urban rail networks in 2010 and national track length measured just under 1,500km. There are more than 40 cities with urban rail projects completed, under construction, or planned.

Urban rail track length is now over 5,000km. CLSA expects expansion to 7,304km by 2020.

Expressways

Focus on interconnectivity

China's National Trunk Highway System became the world's largest expressway network in 2011.

Expansion is focused on extending and interconnecting the current network. The NDRC targets completing 26,000km of expressway by 2020 to take the total length to 150,000km.

Airports

Rapid expansion

Construction of new major airports continues to expand rapidly. Passenger numbers have increased 633% and freight volumes 313% since 2001.

The airport construction boom will continue during the next two five-year plans. The Ministry of Aviation aims to have 260 airports completed by 2020 and 343 by 2025.

Waterways

Pressing inland

China has the largest network of navigable waterways in the world. Maintaining and expanding their length is key for transporting goods to its coastal shipping hubs.

The NDRC targets inland high-grade waterway mileage to increase 26% from 13,600km in 2016 to 17,100km in 2020. Development will focus on capacity expansion projects in the Pearl and Yangtze river deltas and channel construction projects in upstream regions.