While we concentrate on the relative strength of the elements as they cycle through the five phases in the respective monthly charts, we also consider the interplay of the Bazi’s monthly pillars.

While the Hang Seng has wood in its chart, it is yin and not so attractive in a year with yin earth. The pig as an animal, however, belongs to the water group, so expect some growth. Healthcare, education, consumer and environment-related industries will be protected at the beginning and end of 2019, late autumn being the best time for advancment.

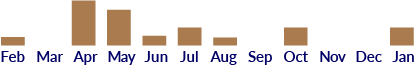

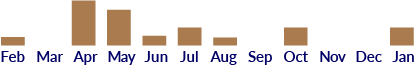

Fire is coursing through the chart this year. Related sectors will rise early on and through the late spring and early summer. October and November may look poor, but they are months ruled by fire so expect some strong performance. Tech stocks should do well, but will weaken through the summer. Telecoms, petroleum byproducts and utilities will also warm wallets and portfolios.

Earth industries can rely on the fire in the chart for a boost this year. Construction and real estate should run well through the late summer. Foreign property markets are likely to be strong. Water and earth sometimes clash and from midyear, distant support may dry up, with the back end looking a little parched.

An overabundance of fire overpowers what little metal there is in the Bazi chart this year, so aside from investing in slag what else is on offer? Earth offers some support through the summer, making it the best time for financials, the law and machinery. But overall, expect a year of restraint rather than progress, more regulation for bankers and transparency in public-service accounting.

This begins three years of water’s rise, not a flood, but if your Board is balanced properly it should successfully surf the tide. Industries associated with tourism, paints, logistics, hospitality and all forms of shipping will do well. Possible brakes include government regulations and tariffs. August and September are ruled by earth and primed to deliver.

While the Hang Seng has wood in its chart, it is yin and not so attractive in a year with yin earth. The pig as an animal however belongs to the water group, so expect some growth. Education and environment-related industries will be protected at the beginning and end of the 2019 - late autumn being the best time for advancing.

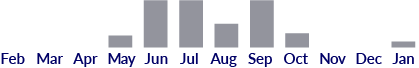

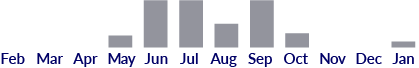

Fire is coursing through the chart this year. Related industries are particularly strong through October and November in ruling months and then in their own cycle early on and through the late spring and early summer. Tech stocks should perform well,but will weaken through the summer. Telecoms, petroleum by products and utilities will also warm wallets and portfolios.

Earth industries can rely on the fire in the chart for a boost this year. Construction and real estate should run well through the late summer. Foreign property markets are likely to be strong.Water and earth sometimes clash and from midyear, distant support may dry up, with the back end looking a little parched.

An overabundance of fire overpowers what little metal there is in the bazi chart this year. Wood and metal are also clashing and with this element so weak, financials, law and management firms are in for a bad spell. Earth offers some protection, particularly in the summer, so it’s a case of restraint on progress rather than outright losses. If you are in banking, expect more regulation.

This begins three years of water’s rise, not a flood, but if your Board is balanced properly it should successfully surf the tide.Industries associated with tourism, paints, logistics, hospitality and all forms of shipping will do well. Possible brakes include government regulations and tariffs. August and September are ruled by earth and primed to deliver.