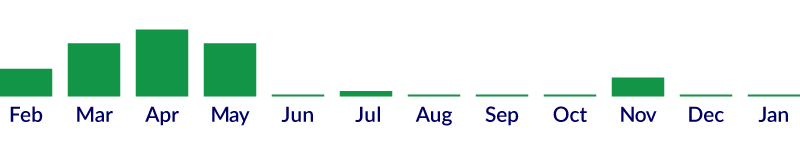

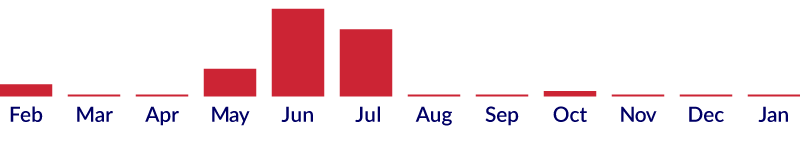

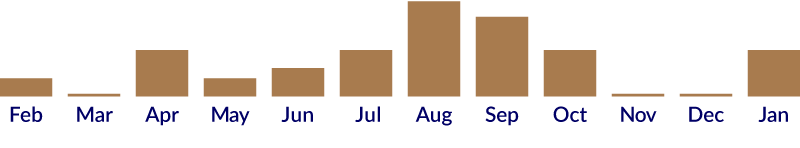

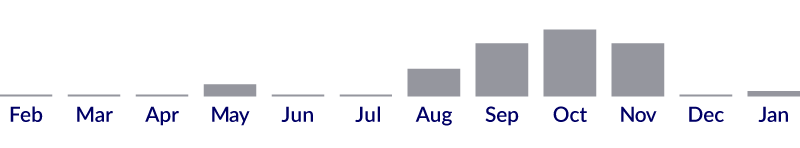

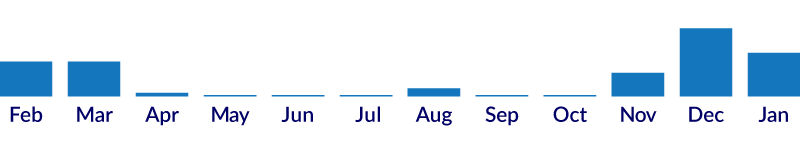

Elementary analysis

Somewhere in the clouds above, revolve the qi of the five phases. Down here in our world, these phases manifest as concrete structures and a correct understanding of how they function tells us what they are likely to do on our earthly domain. We thus present the overall picture for industries associated with each of the phases across the year. Modified slightly by the ruling forces in each month, the decline of one element may be tempered by the position of a seemingly unrelated element and vice-versa. Water, for instance conquers fire, but this can be mitigated by having a surplus of wood, which can augment the fire. And so the dance goes on.