A favourable exchange rate is driving Hong Kong’s appeal as a shopping and travel destination. The SAR has gained share as the most visited outbound destination and most desirable place to go shopping. Macau’s popularity also edged up.

In our latest Chinese tourist survey, we talked to 407 experienced outbound travellers

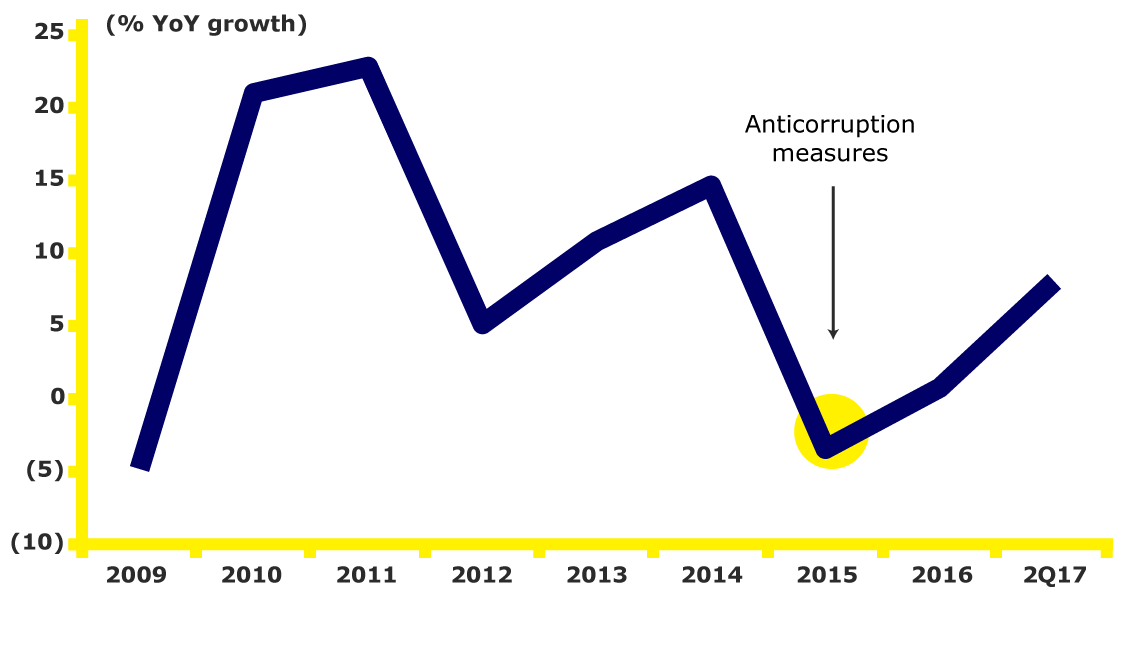

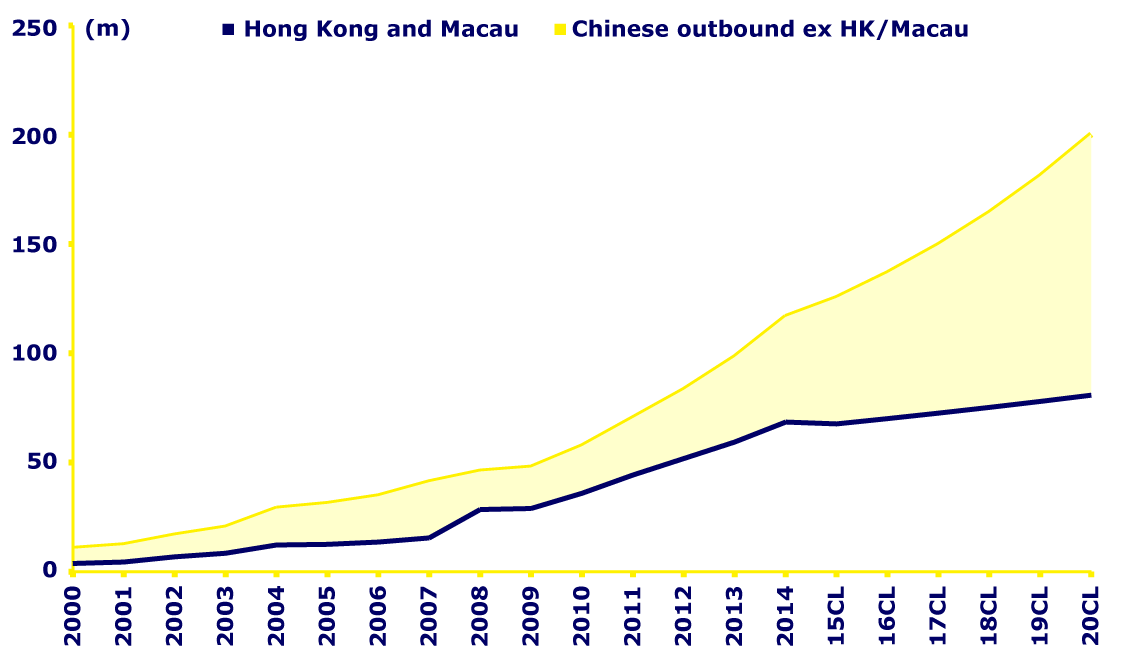

Increased affordability, more holidays, easing travel restrictions and a desire to experience the world are driving exponential outbound tourist growth

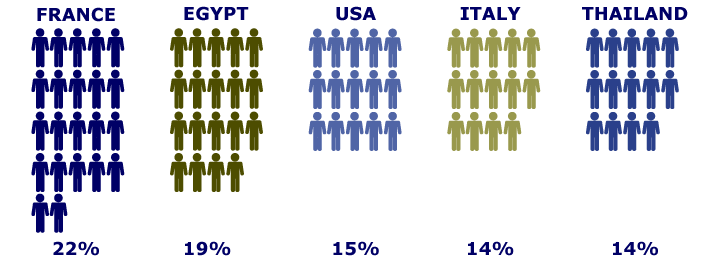

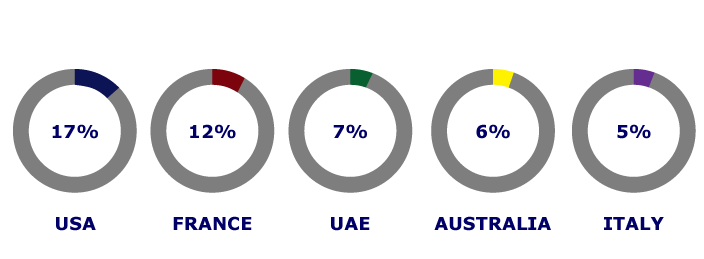

'List three destinations you would consider for a sightseeing or cultural holiday in the next three years'

'If money was no object, where would you like to visit most?'

When asked for their impressions of the destinations they had visited in the past three years, people most often cited: 'nice environment'; 'experience of foreign culture'; 'expand my vision' and 'beautiful scenery'.

Only in Hong Kong was 'shopping paradise' the top impression mentioned.

We are sticking with our forecast of 200 million outbound trips by 2020 which implies a three-year Cagr of 10% over 2017-20.

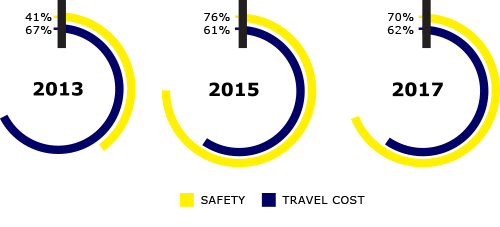

SAFETY FIRST

Safety remains a key concern, ahead of travel cost, when considering potential destinations given events such as the terrorist attacks in Europe, Syrian crisis and political instability on the Korean Peninsula

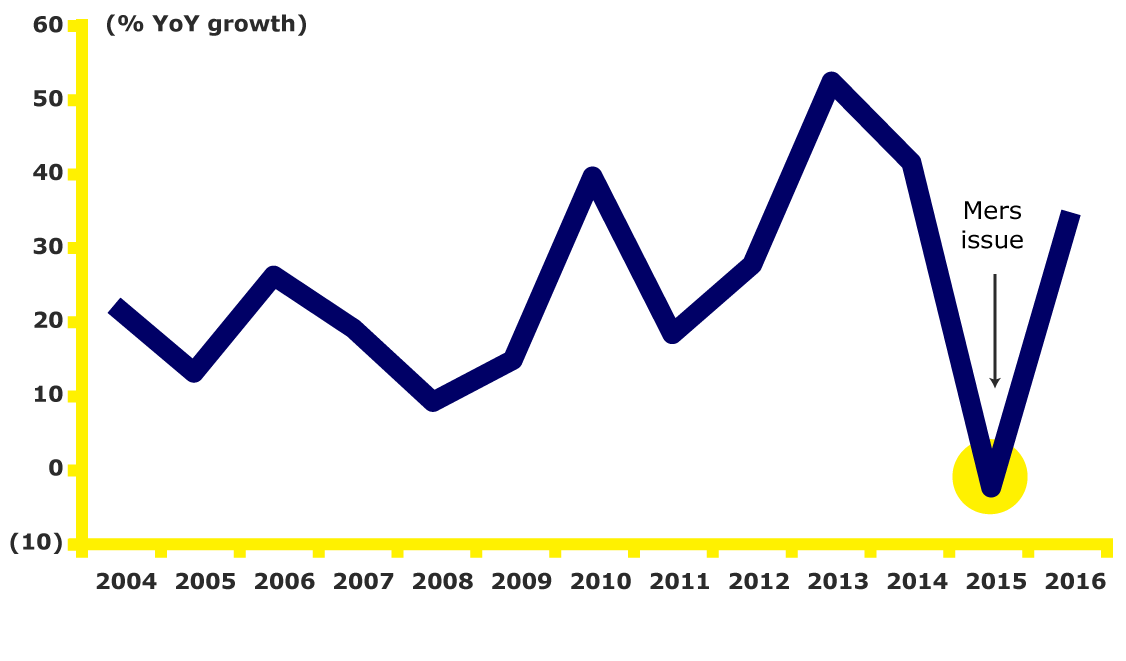

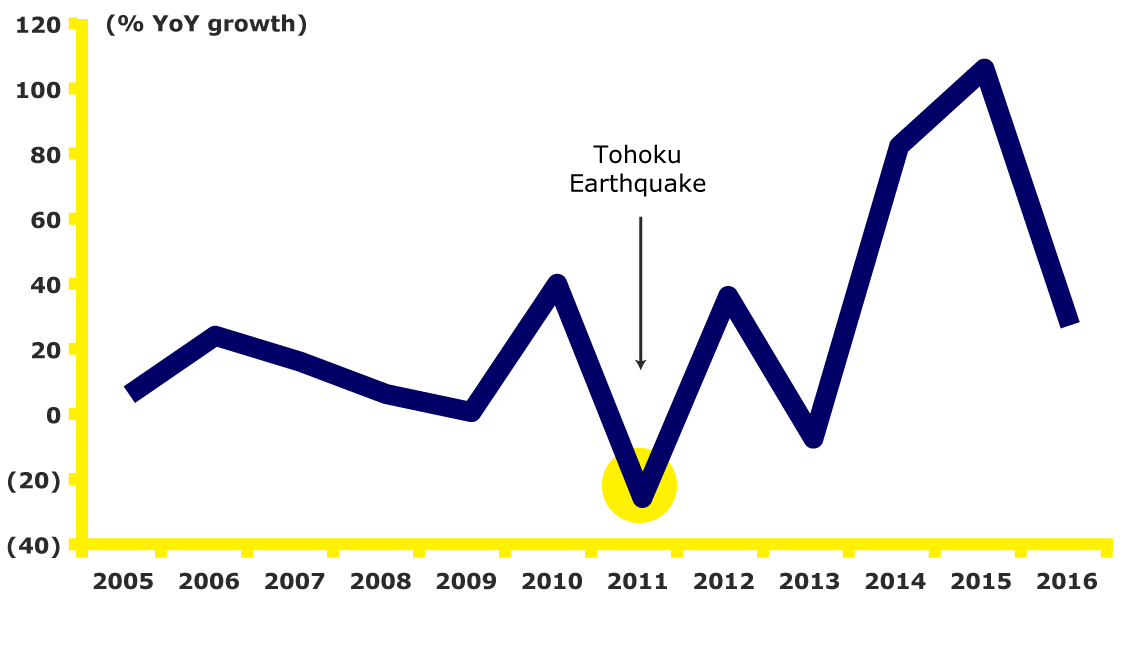

How politics, natural disasters and disease all negatively impact tourism

WHAT's HOT

Hong Kong has plenty of competition

Japan, Thailand and the USA are top destinations while Australia has risen up the ranks impressively. South Korea’s plan to install a terminal-high-altitude-area-defence system (THAAD) system has negatively impacted its tourist numbers.

Diplomatic tensions with China have led to a sharp fall in inbound traffic, which was down by 67% YoY in April 2017.

Some 42% of those who have visited Japan will consider returning in the next three years - one of the highest future retention rates.

A ban on zero-dollar tour group operators has slowed Chinese inflows, but Russian travellers are filling the gap.

The USA is the top choice for Chinese if money was no object, but President Donald Trump’s tougher screening of visa applicants poses a potential risk.

After two years of declining inflows, top-visited destination Hong Kong is seeing a rebound helped by a new train link and appealing tourism events.

China remains the second-largest country for arrivals and is also the single-biggest contributor to tourist receipts.

With a growing number of younger, more seasoned individual Chinese travellers, France is the top destination for sightseeing or cultural holidays.

With Beijing limiting group tours to a more independently minded Taiwan, Chinese inflows plunged and the tourist sector is under pressure.

Thanks to the 10-year frequent-traveller visas available to Chinese mainlanders, Australia jumped from 10th to fourth most-popular target destination.

CHINA ONLINE TRAVEL: GROWING AT TRIPLE-DIGIT RATE

Outbound travel has become a big new growth engine of China’s online travel agencies (OTAs). Ctrip is the clear leader, with 70% of outbound travellers that use online-booking services using its websites.

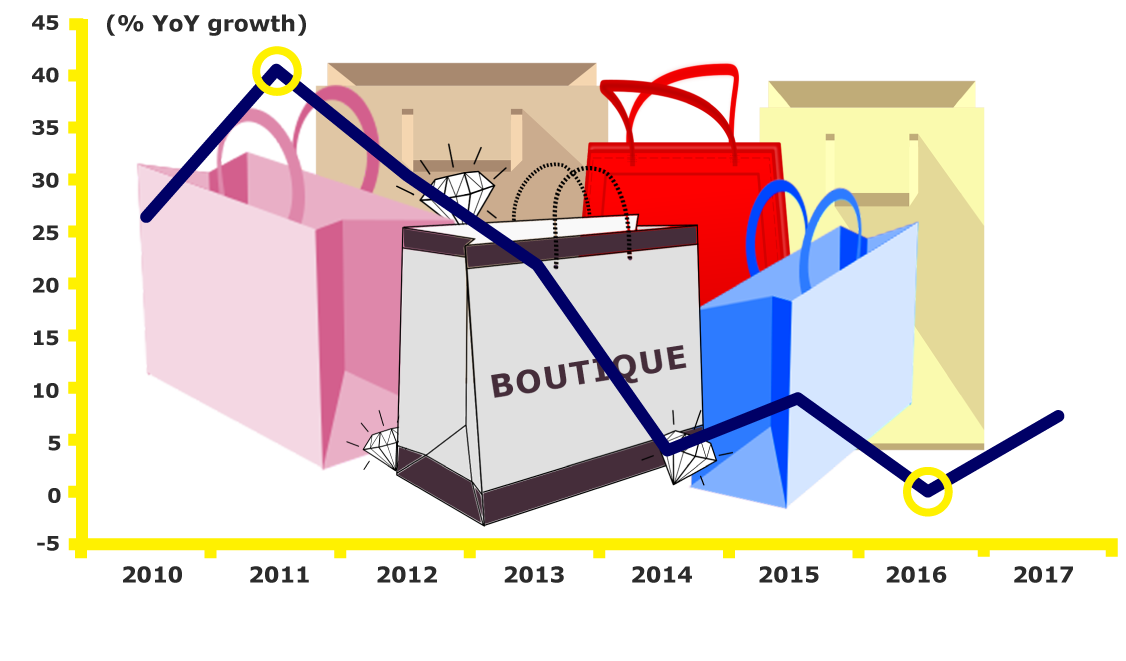

LUXURY’S GLAMOUROUS

COMEBACK

We expect luxury sales to Chinese to represent 35% of global sales in 2020. While 2016 was challenging, interrupted by terrorist attacks in Europe and weaker spending in the USA, the tide turned in 3Q16, which was largely driven by the wealth effect among Chinese consumers. Forex should be a key swing factor in 2017.

MULTI-DECADE GROWTH STORY

leading edge thematics

CLSA is committed to providing thematic research that tells the story of Asia, an incredible and complex epic of profound global-trade growth, unprecedented capital flows and a worldwide economy that increasingly knows no borders.